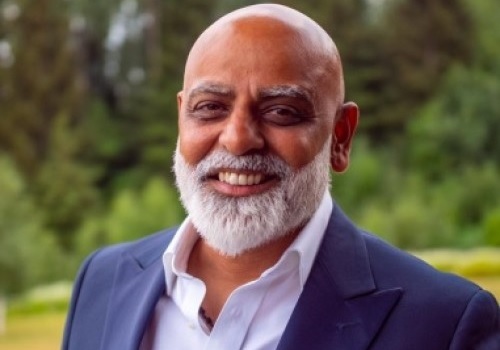

Perspective on Sovereign Gold Bonds Tranche 2 by Nish Bhatt, Millwood Kane International

Below is perspective on Sovereign Gold Bonds Tranche By Nish Bhatt, Founder & CEO, Millwood Kane International

“ The price for the second tranche of Sovereign Gold Bond has been fixed at Rs 4842/gm. Based on their risk profile investors should look at allocating 5-15% of their capital to Gold. Sovereign Gold Bond is a better alternative to physical gold as there is no risk of theft, storage charge, and to top it up it comes with an interest-bearing coupon.

Gold prices have been on an up move due to uncertainties created by the second wave of COVID-19 cases, concerns of rising inflation in the US, and a weaker US dollar. Gold prices have been trading near a

4-month high in the international market.

The high volatility in cryptocurrencies has led to investors flocking back to gold for stability.

Moving forward the critical US Fed meeting next month on possible reversal of liquidity measures, the impact of the second wave, inflation level, and unemployment data in the US will guide gold prices..”

Above views are of the author and not of the website kindly read disclaimer

Tag News

More News

USDA Sees India`s 2025-26 Cotton Output Flat by Amit Gupta, Kedia Advisory