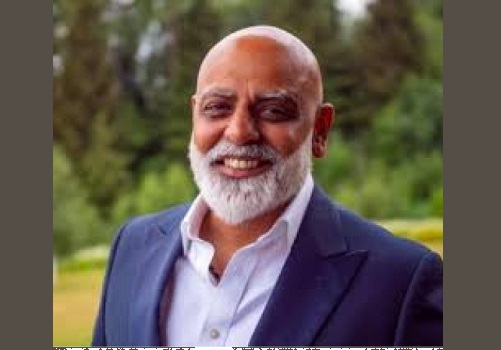

Comment on What does rupee depreciation mean for Indian investors investing abroad? By Mr. Viram Shah, Vested Finance

Below is comment on What does rupee depreciation mean for Indian investors investing abroad? By Mr. Viram Shah, Co-Founder and CEO at Vested Finance

Rupee has hit an all-time low and falls against the dollar

“Your investments in the Indian stock market are in rupees. However, when your invest overseas (in the US stock markets) it is in dollars. You first convert your money into USD to invest in the US stock markets and then back to INR when you redeem it. When the rupee depreciates against the dollar, it effectively means an additional return on your US investments. With the rupee hitting a record low against the USD, Indian investors in US markers will stand to benefit. So far in the current calendar year, the rupee has depreciated by almost 4% against the dollar.

The rupee has depreciated by approximately 50% compared to the US dollar in the past 10 years.

So, 10 years ago, if you had invested Rs. 5,000 in Nifty 500 (Indian stock market), your investment would have grown to approximately Rs. 15,000 in 2022. But, if you had invested the same 100 dollars in the S&P500 (US stock market), your investment would have grown to approximately $320 in 2022. That is nearly Rs 24,000.”

Above views are of the author and not of the website kindly read disclaimer

Tag News

More News

USD/INR Nears Record High Amid Dollar Strength, Rupee Weakness by Amit Gupta, Kedia Advisory