Buy HDFC Life Insurance Company Ltd For Target Rs. 823 - ICICI Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

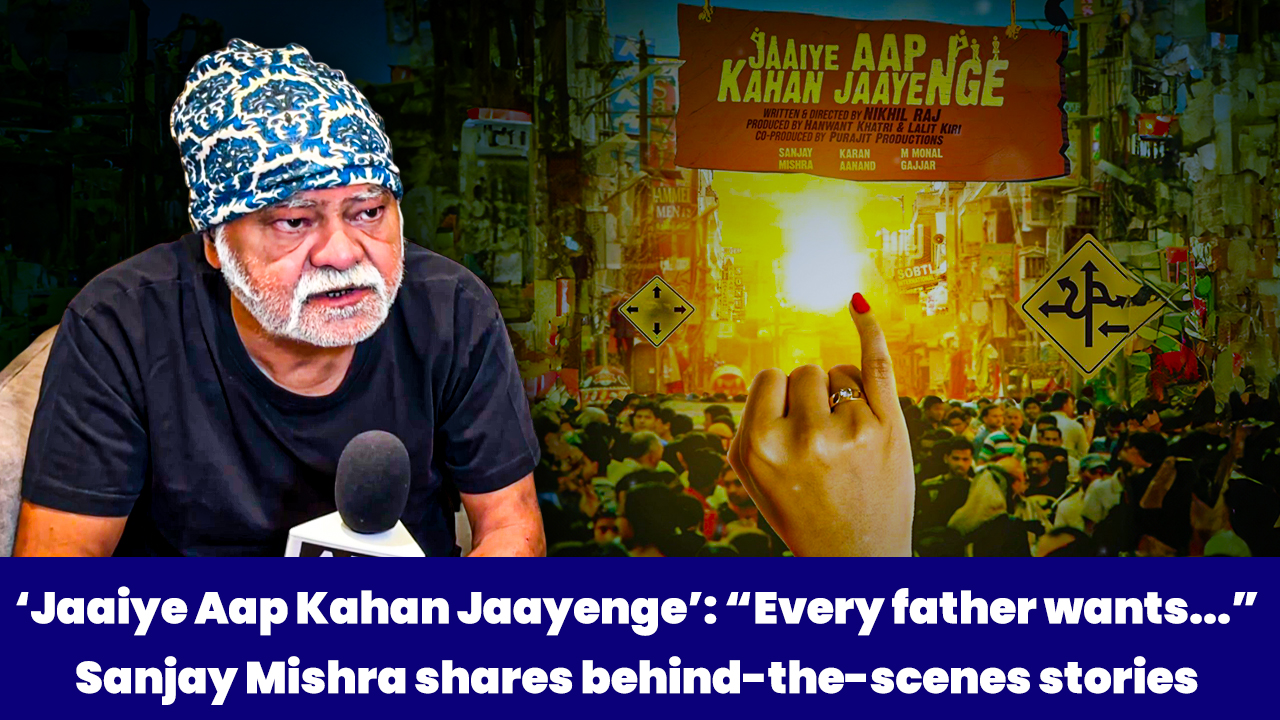

Well placed to benefit from strong demand outlook

We reiterate our BUY rating on HDFC Life led by better outlook of non-par guaranteed portfolio, continued strong demand for protection and organic growth levers

Increase in guaranteed rates and likely increase in interest rates ahead will make non-par portfolio more attractive.

HDFC Life has increased rates in its guaranteed savings offering. When we look at derivative (FRA) MTMs, some peers have reported losses in FY21 indicating interest rates have been higher than the exercise rates of these derivatives. This, along with possible increase in interest rate outlook, will enable insurers to offer higher rates for their non-par guaranteed portfolio. HDFC Life is well placed to benefit from this. Our channel checks indicate healthy demand for this segment. Non-par savings was 26% of total APE in FY21 and has room to increase (it was 34% of mix in FY20). Higher non-par mix will lead to improvement in margins.

Sum assured growth has also been healthy for HDFC Life.

The individual sum assured market share for HDFC Life has improved from 11.7%/11.2% in FY20/21 to 14.3% FY22TD (data up to May’21). The group sum assured market share of HDFC Life stands at 9.3% as of May’21 compared to 24/12% in FY20/21 indicating a possible scope of improvement.

Multiple growth levers remain in place including

1) recovery of credit protect NBP (26% YoY growth in Q4FY21 though it declined 19% in FY21);

2) higher growth in agency/direct business, up 8% / 0.1% in FY21 (HDLI also forged new partnerships in FY21 with Yes Bank, SBI Capital Markets, State Bank of Mauritius, Doha Bank, Edelweiss); and

3) better enablement of medical underwriting (HDLI followed a calibrated growth strategy in retail protection due to supply-side constraints and headwinds to medical testing, especially beyond tier-1 locations).

Covid claims remain a short-term concern.

Depending upon the provisions already taken in FY21, insurers might have to take additional provisioning in FY22. However, this remains a one-off event (HDFC Life had no negative operational variance between FY16-20). Overall demand for protection remains very strong. Higher pricing and improved medical underwriting are available profit levers.

Reiterate BUY.

We factor VNB margins of 27/28.5% with APE growth of 18/18% in FY22/FY23E. We expect HDLI to accumulate Rs58.7bn of new business and Rs45.4bn of unwind (@8%) over FY22E / FY23E to reach an embedded value (EV) of Rs358.3bn by FY23E. We value HDLI based on 40x new business value of Rs33bn in FY23E to arrive at a target price of Rs823. At our target price, the stock will trade at 4.6x FY23E P/EV. We factor negative variance of Rs10bn in FY22 to counter possible covid claims and change in interest rates.

To Read Complete Report & Disclaimer Click Here

For More ICICI Securities Disclaimer https://www.icicisecurities.com/AboutUs.aspx?About=7

Above views are of the author and not of the website kindly read disclaimer

Ltd.jpg)