Buy Copper Jun 2022 @ 767.00 SL 762.00 TGT 774.00-780.00. MCX - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

COPPER

Copper trading range for the day is 761.5-783.3.

Copper fell on concerns that slowing economic growth and COVID-19 lockdowns in top consumer China would depress demand.

Weak U.S. economic data and Chinese efforts to control coronavirus outbreaks have fuelled fears that a global slowdown could be more severe

Chinese metals demand was weak across the board in March and April but is expected to pick up in the second half of 2022

Warehouse stock for Copper at LME was at 168150mt that is down by -2500mt.

BUY COPPER JUN 2022 @ 767.00 SL 762.00 TGT 774.00-780.00.MCX

ZINC

Zinc trading range for the day is 315.9-328.5.

Zinc dropped on concerns about the global economy's health and a firm U.S. dollar.

New U.S. home sales fell 16.6% month-on-month in April, the largest decline in nine years.

Global zinc market flips to deficit of 6,300 T in March – ILZSG

Warehouse stock for Zinc at LME was at 85050mt that is down by -600mt.

BUY ZINC JUN 2022 @ 320.00 SL 315.00 TGT 328.00-332.00.MCX

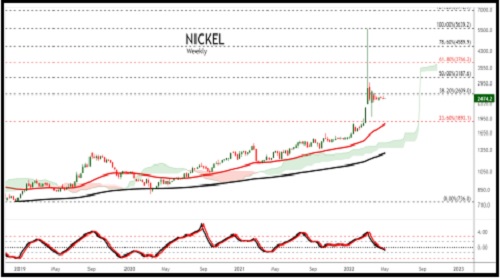

NICKEL

Nickel trading range for the day is 2211.9-2211.9.

Nickel settled flat as Sumitomo Metal sees global nickel demand for battery use at 410,000 in 2022

Global nickel market sees surplus in February – INSG

Nickel briquette prices stood above 200,000 yuan/mt, and demand from nickel sulphate plants may contract.

Warehouse stock for Nickel at LME was at 72600mt that is up by 480mt.

SELL NICKEL JUN 2022 @ 0.00 SL 0.00 TGT 0.00-0.00.MCX

ALUMINIUM

Aluminium trading range for the day is 235.4-246.4.

Aluminium dropped as the market worried about economic recession as the latest home sales data in the US indicated contracting demand.

Aluminium capacity is resuming steadily and the output has grown palpably, but the pace may slow down.

The demand side has not improved substantially yet though downstream production resumption is progressing smoothly.

Warehouse stock for Aluminium at LME was at 481650mt that is down by -5825mt.

BUY ALUMINIUM JUN 2022 @ 239.00 SL 235.00 TGT 245.00-248.00.MCX

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaime

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">