Buy Birlasoft Ltd : Strong broad-based demand; talent crunch only constraint - Emkay Global

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Buy Birlasoft Ltd For Target Rs.500

Strong broad-based demand; talent crunch only constraint

* Management remains confident of accelerating revenue growth on the back of broadbased demand and increased traction in the areas of Cloud, Digital and Cybersecurity. While the shortage of talent is a constraint on achieving higher growth (20%), BSOFT is confident of delivering revenue growth in the mid-teens in FY22.

* BSOFT expects strong growth in deal ACV; however, TCV growth may remain low as the company is signing many digital transformation deals, which are by nature small in size. The deal pipeline remains robust.

* Supply-side challenges persist due to an industry-wide shortage of talent. Management expects the situation to improve by the end of FY22. Supply-side hurdles, wage hikes and high subcontracting costs could limit any upside in margins in the near term.

* Considering improving earnings predictability (annuity revenue at ~70% from 60% in Q1FY21), strong earnings trajectory (~25% EPS CAGR over FY21-24E) and robust cash generation, we retain Buy on BSOFT with a TP (Sep’22E) of Rs500 at 25x Sep’23E EPS.

Aims for revenue growth in mid-teens in FY22:

Demand remains robust across verticals, specifically in the areas of Cloud, Digital and Cybersecurity. Management is confident of delivering revenue growth in the mid-teens in FY22, driven by 1) strong deal intake (USD861mn TCV in LTM; 13% YoY), 2) robust deal pipeline and improving win rates, 3) growing annuity revenue, and 4) broad-based demand.

Management indicated that the supply-side issue is the only constraint to growth and that BSOFT could have achieved revenue growth of ~20% in FY22 in the absence of the talent crunch. It expects the supplyside constraints to ease by the end of FY22. Annuity revenue is currently at ~70% and management aims to take it to 75% by FY22-end, which would further improve revenue predictability. Management indicated that BSOFT will continue to make investments to capitalize on demand.

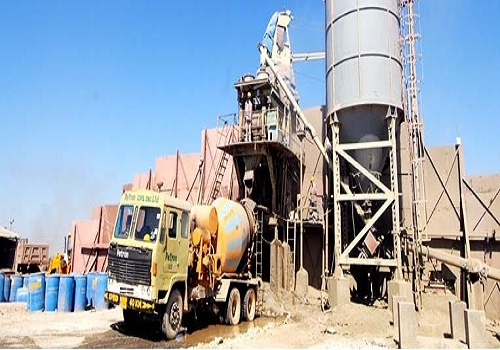

As part of its micro vertical strategy, BSOFT has identified medical devices (part of Life sciences), high tech (part of Manufacturing; growing at over 20%), heavy industries (Cement, Building Materials; part of Manufacturing), and lending and payment (part of BFSI) as key micro verticals to focus on in order to accelerate growth. BSOFT has also improved its partnership status with Microsoft Azure and AWS, while progress on Google cloud has been slow but may soon accelerate.

Talent shortage to weigh on margins in near term:

BSOFT delivered 16% EBITDAM in Q1. Management expects to sustain EBITDAM at ~15% in FY22, as it expects headwinds on account of wage hikes (wef Jul’21), high attrition and subcontracting costs, and investments in sales and capability building, which would be partially offset by revenue growth-led operating leverage, higher offshoring and other efficiencies. Management indicated that the company’s priority currently is to make the required investments to capture high demand and that it is comfortable with operating at ~15% margins in the near term.

To Read Complete Report & Disclaimer Click Here

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : Adani Ports and Special Economic Zone Ltd and Birlasoft Limited By ICICI Direct

More News

Buy Maruti Suzuki Ltd : Strategy for net zero emissions needs to be India focused - Motilal ...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">