Bullion prices traded steady on Wednesday with spot gold prices at COMEX - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

GLOBAL MARKET ROUND UP

Commodity prices traded mixed on Tuesday with Bullion prices kept range bound trading despite of weaker dollar. Crude oil prices traded weak on rise in weekly inventories and progress in Iran talks while base metals kept muted trading witnessing some selling pressure along with weak equity indices.

US Housing starts tumbled 9.5% to a seasonally adjusted annual rate of 1.569 million units last month, the Commerce Department said on Tuesday. Economists polled by Dow Jones had forecast starts falling to a rate of 1.7 million units in April.

Major U.S. stock benchmarks closed lower Tuesday as enthusiasm centered on a strong round of earnings from major retailers, including Dow components Home Depot Inc. and Walmart Inc., appeared to wane amid inflation concerns

BULLION

Bullion prices traded steady on Wednesday with spot gold prices at COMEX were trading near $1869 per ounce while spot silver prices at COMEX were trading over half a percent down at $28 per ounce in the morning trade. The precious metals kept range bound trading with gold hovering near four month high on mixed global cues. The weaker dollar and fall in equity indices supported bullion prices to limit downside. The Europe and UK are easing lockdown restrictions which may limit some gains in gold prices. However, market focus will be on FED minutes of tonight.

We expect bullion prices to trade sideways to up for the day. MCX Gold June resistance for the day lies at Rs. 48700 per 10 grams with support at Rs. 48000 per 10 grams. MCX Silver May support lies at Rs. 71200 per KG, resistance at Rs. 74000 per KG.

ENERGY

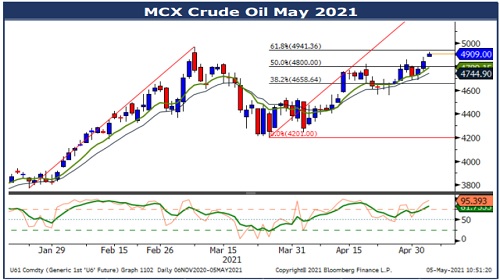

Crude oil prices traded lower with benchmark NYMEX WTI crude oil prices were trading down by more than 1% near $64.77 per barrel in the morning trade. Crude oil prices witnessed selling on expectation of Iranian supply returns with progress on nuclear deal talks. The lifting of Iranian sanctions may increase global oil supply putting more pressure on oil prices. Crude oil prices declined with rise in weekly inventories as per API institute.

We expect crude oil prices to trade sideways to down for the day. MCX Crude Oil June support lies at Rs. 4690 per barrel with resistance at Rs. 4830 per barrel.

BASE METALS

Base metals prices traded weak with most of the metals traded in red on Wednesday. Base metals complex traded under pressure over higher inflation concerns which may prompt China to take policy action. Investors and traders are also speculating over FED minutes due today eyeing in any signal of hike in interest rates. The selling in equity indices has also pressured base metals to trade weak.

Base metals are expected to trade sideways to down for the day. MCX Copper May support lies at Rs. 770 and resistance at Rs. 787. MCX Zinc May support lies at Rs. 234, resistance at Rs. 240. MCX Nickel May support lies at Rs. 1290 with resistance at Rs. 1350.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">