Benchmarks likely to make gap-up opening of new week

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

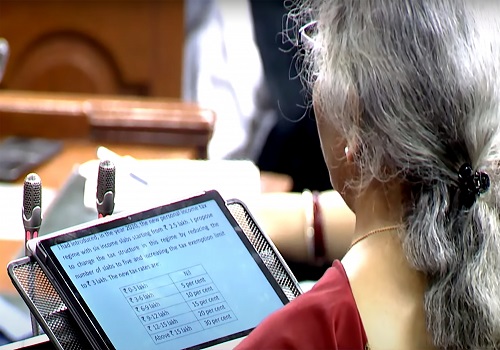

Indian markets ended flat on Friday after rising in early deals as FMCG, energy, pharma and metal stocks declined. Today, the markets are likely to get gap-up opening of new week on firm global cues. Positive macro-economic data may aid the sentiments in markets. The Index of Industrial Production (IIP) grew by 1 per cent in December on a year-on-year (Y-o-Y) basis compared with a 2 per cent decline in the previous month, the data released by the National Statistical Office showed. On the other hand, the consumer price index (CPI)-based inflation rate fell for the third consecutive month to 4.06 per cent in January as food inflation, pulled down by deflation in vegetables, drastically declined. Traders will be getting encouragement as PHDCCI said expectations that the country's GDP would record growth in the third and fourth quarters of 2020-21 are getting stronger on account of various reforms undertaken by the government in the last ten months. Some support will also come as Chief Economic AdviserK V Subramanian said the reform measures announced in the Budget 2021-22 will play a big role in India becoming a $5 trillion economy and beyond. Besides, continuing their buying trend, foreign portfolio investors (FPIs) have pumped in a net Rs 22,038 crore into the Indian markets in February so far amid positive sentiments around the Union Budget. Traders may take note of Finance Minister Nirmala Sitharaman’s statement that the government, undeterred by the COVID-19 pandemic, has been pursuing reforms for achieving sustained long-term growth in a bid to make India one of the top economies of the world in the coming decades. There will be some buzz in insurance industry stocks with report that the Finance Ministry will infuse Rs 3,000 crore capital into state-owned general insurance companies during the current quarter in a bid to improve their financial health. Metal stocks will be in focus as doing away with restrictive conditions for use of steel in highways construction, the government announced that all kinds of steel will be allowed for highways provided these meet the quality parameters. Meanwhile, China, Hong Kong, Taiwan stock markets were closed for Lunar New Year holidays.

The US markets settled higher on Friday amid anticipation of new fiscal aid from Washington to help the US economy recover. Asian markets are trading in green on Monday as successful coronavirus vaccine rollouts globally raise hopes of a rapid economic recovery amid new fiscal aid from Washington.

Back home, Indian equity benchmarks ended Friday's volatile session on a flat note mainly dragged by losses in Telecom, Metal and FMCG stocks. Markets made positive start and traded with marginal gains, as traders took some support with Moody's Investors Service in its latest report stated that India's economic recovery reduces the risk of a sharp deterioration in public sector banks' (PSBs) asset quality. But, it said the capital would remain insufficient to support credit growth and absorb unexpected shocks. Buying further crept in as leading trade bodies are expecting that the outbound shipments will rise in the coming months as the uncertainty in global markets began to subside. Domestic sentiments remained positive as the government approved applications from several medical devices manufacturers under the Production Linked Incentive (PLI) scheme for the promotion of domestic manufacturing. However, key gauges erased all the gains to turn negative in late afternoon session, tracking weak cues from global markets. Traders also remained on sidelines ahead of the release of Index of Industrial Production (IIP) data for December and Consumer Price Index (CPI) data for January later in the day. Traders were cautious even after Union Minister of State for Finance Anurag Thakur has said that the budget shows hope to build a new India and will lead the nation on the path of becoming an economic and manufacturing powerhouse. Traders took note of Commerce and Industry Minister Piyush Goyal’s statement that the government has constituted a committee comprising members from public and private sectors to look into issues like promoting localisation and boosting manufacturing. Finally, the BSE Sensex rose 12.78 points or 0.02% to 51,544.30, while the CNX Nifty was down by 10.00 points or 0.07% to 15,163.30.

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

The downside rally could be testing all the way up to 17900-17750 levels in the upcoming ses...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">