Benchmark index is likely to open gap up on the back of favourable global cues and trade with positive bias today - Monarch Networth Capital

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

TECHNICAL OUTLOOK

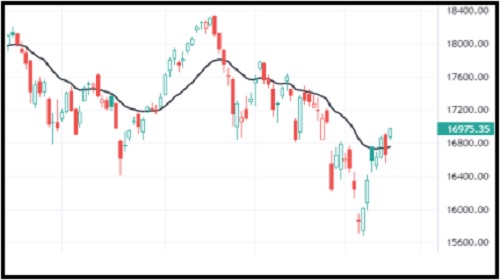

* Benchmark index traded on a positive note as it closed with 1.87% gain at 16976 level. Banking index performed slightly better than the benchmark index as it closed with 2.07% gain at 35748 level

* India VIX closed with 9.76% cut at 24.12 level

* Among Sectors, REALTY and METAL index outperformed as they closed with 3.64% and 2.63% gains. Broader market traded in line with the benchmark index as both MIDCAP and SMALLCAP index closed with 2.01% and 1.17% gains respectively.

* Advance/Decline ratio was in favour of advances and cash turnover was lower than 5-day average. Both FII and DII were net buyers in the cash segment .

* European markets (DAX) and US markets (DJIA) closed with sharp gains after FOMC announced its interest rate decision yesterday. Asian Markets are following suit and trading higher today.

NIFTY (Daily) Chart

Intraday Market Outlook

* Benchmark index is likely to open gap up on the back of favourable global cues and trade with positive bias today. Index has support at 16900 – 16800 level and resistance at 17300 - 17400 level.

* Banking index is likely to trade in line with benchmark index with support at 35700 - 35500 level and resistance at 36700 - 37000 level.

* FEDERALBNK has closed with bullish candlestick formation above 21 EMA and is likely to continue it positive momentum today as well.

BANK NIFTY (Daily) Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.mnclgroup.com/disclaimer

SEBI Registration Number : INZ000043833

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Reserve Bank of India makes 'Legal Entity Identifier' must for Rs 50 cr plus cross-border deals

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">