Bank Nifty opened negative and traded southwards for most part of the day By Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

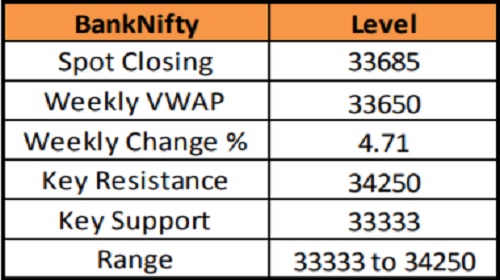

BANKNIFTY : 33685

Bank Nifty opened negative and traded southwards for most part of the day. Profit booking decline was seen in banking stocks and weakness took the index to 33600 levels. It formed a Doji sort of candle on daily scale as it closed near to its opening levels with losses of around 240 points. Now it has to hold above 33500 zones to witness an up move towards 34000 and 34250 zones while on the downside support exists at 33333 and 33000 levels

Expiry day point of view:

Overall trend is likely to remain positive to range bound and need to hold above 33500 zones for an up move towards 34000/34250 zones while on the downside support exists at 33333 then 33000 levels. Option traders are suggested to trade with nearby Call like 33800, 33900 strikes or Bull Call Ladder spread

Key Data

Trading Range: Expected immediate trading range : 33333/33500 to 34000/34250 zones

Option Writing : Option writers are suggested to write OTM 34300/34400 Call and 32600/ 32700 Put with strict stop loss

Weekly Change : Bank Nifty is up by 4.71% at 33685 on weekly basis. Bank Nifty VWAP of the week is near to 33650 levels and it is trading near to the same indicates bullish bias with buying on decline.

Option Weekly Activity

NIFTY : 15030

Nifty index opened slightly negative and moved in a negative to rang bound manner throughout the day. It breached its previous day's low but took support at around 15000 levels. It closed near its low levels with losses of around 80 points. Technically, it formed a Bearish candle on daily scale and negated its higher highs - higher lows formation of the last two sessions. Now, it has to hold above 14950-15000 zones to witness an up move towards 15200 then 15350 zones while on the downside support exists at 14900 and 14800 zones

Expiry day point of view: Overall trend is positive to range bound till it holds above 14950-15000 zones to witness an up move towards 15200 zones while on the downside support is seen at 14900 then 14800 zones. Buy nearby 15000 and 15050 Call or Bull Call Ladder Spread.

Trading Range : Expected wider trading range : 14900 to 15150/15200 zones

Option Writing : Aggressive Option writers can sell 15200 Call and 14850 Put with strict double stop loss

Weekly Change : Nifty index is up by 2.40% at 15030 on a weekly basis. Nifty VWAP of the week is near to 15015 levels and it is trading near to the same indicates overall range bound bias with buy on declines.

Option Weekly Activity

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Nifty sustained the pressure as it moved back within its ongoing oscillating range of 16760-...