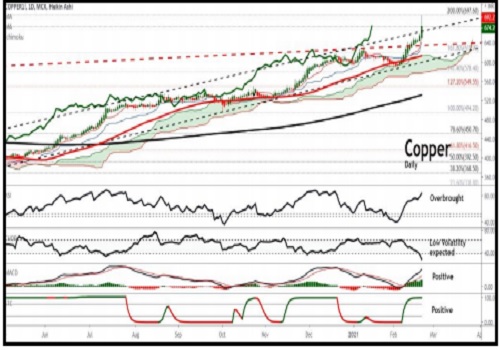

BUY COPPER MAR 2021 @ 692.00 SL 688.00 TGT 698.00-704.00.MCX

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

COPPER

Copper trading range for the day is 674.3-721.1.

Copper prices hit life time high extending a rally that has been driven mainly by expectation of a pick-up in demand after the Chinese New Year.

Copper stocks in deposits registered with the LME total 76,025 tonnes, close to its lowest level since 2005

The three-month spot copper premium over metal is increasing, suggesting a shortage of supply nearby.

Warehouse stock for Copper at LME was at 74900mt that is down by -800mt.

BUY COPPER MAR 2021 @ 692.00 SL 688.00 TGT 698.00-704.00.MCX

ZINC

Zinc trading range for the day is 225.3-236.7.

Zinc prices rose as risk appetite was stoked by better-than-expected economic data

China kept the one-year loan prime rate (LPR) unchanged at 3.85%, largely in line with expectations.

The euro zone flash composite PMI, combining manufacturing and services activity, climbed to 48.1 in February from 47.8 in January

Warehouse stock for Zinc at LME was at 273175mt that is down by -3350mt.

BUY ZINC MAR 2021 @ 229.00 SL 227.00 TGT 231.50-233.00.MCX

NICKEL

Nickel trading range for the day is 1369.5-1479.1.

Nickel dropped on profit booking after prices gained supported by the macro environment and positive fundamentals.

Survey showed that orders from downstream precursor factories continued to be strong.

Survey showed that China's nickel sulphate supply in January stood at 16,000 metal mt, and the total demand came in at 17,000 metal mt.

Warehouse stock for Nickel at LME was at 249150mt that is down by -330mt.

BUY NICKEL MAR 2021 @ 1402.00 SL 1388.00 TGT 1420.00-1435.00.MCX

ALUMINIUM

Aluminium trading range for the day is 170.2-175.6.

Aluminium gained as dollar lost ground as market participants favored currencies associated with risk-on sentiment over the safe-haven greenback

The impact of domestic supply and demand mismatch on short-term sentiment fluctuations in the market after the CNY should continue to be monitored.

Economic data showed that retail sales increased by 5.3% in January, the biggest increase in seven months.

Warehouse stock for Aluminium at LME was at 1349150mt that is down by -5000mt.

L ALUMINIUM MAR 2021 @ 172.40 SL 170,80 TGT 174.00-175.20.MCX

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">