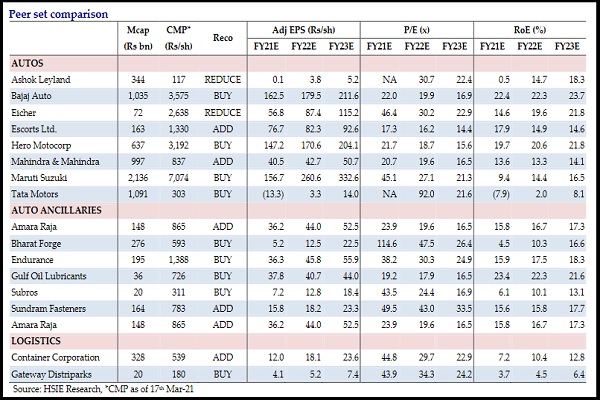

Auto Sector Update By HDFC Securities

Key themes: Combustion, Diversification, Electrification

We hosted the ‘HSIE Autos and Mobility Conference’, which was attended by five auto OEMs, five parts suppliers, and three startups, amongst others. The key themes that emerged from the conference were electrification and diversification, as the industry is preparing to diversify beyond combustion engines. OEMs are increasingly investing in EV and hybrid technology while auto parts companies are seeking to de-risk their customer mix by foraying into the non-auto space including defence, aerospace, industrial and renewable segments. However, the pace of transition is expected to be gradual with ICE engines remaining dominant in the near to medium term, particularly in India.

* The keynote speaker – Mr Vivek Chaand Sehgal aptly summarised the changing environment for the industry, where auto OEMs and suppliers will be increasingly agnostic to evolving technologies across ICE, hybrid and EV products. While the industry is gearing up for the emerging ‘CASE’ trends, the pace of transition is expected to be gradual with ICE engines remaining dominant in the near to medium term, particularly in India. Based on estimates highlighted by various speakers, the wider acceptance of EVs will be from 2025-2030 onwards.

* EVs: In conversations with participants, while the path to adoption of EVs remains unclear, as India has infrastructure challenges, managements are ramping up investments (to avoid missing the bus). Along with developing electric products inhouse, OEMs are open to collaborations, to reduce the speed-to-market as well as maintain capital efficiency. Part suppliers are attempting to be segment agnostic, developing components for ICE, hybrid and EV products. The most aggressive on EV launches is Tata Motors (both for India as well as at JLR). On the other hand, Hero has adopted a dual strategy of investing in startups as well as developing vehicles inhouse.

* Diversification: The auto part suppliers are diversifying their customer mix beyond the traditional auto segment to partially de-risk their business models. The companies have varied targets of deriving non-auto revenues - Motherson Sumi is targeting to achieve 25% of its revenues from non-auto by FY25 while Sundram Fasteners is currently at ~10% and wants to focus more on the renewables segment. Bharat Forge already derives 35-40% of revenues from non-auto and is building capabilities in the defence segment, which can be a significant growth opportunity.

* Auto startups are investing in building ecosystems for EVs, which will include finance and maintenance of the vehicles. This step would enhance their adoption. Further, to encourage shared mobility, 2W ride-sharing startups are expanding into tier-II cities, where there is restricted availability of public transport.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Above views are of the author and not of the website kindly read disclaimer

More News

Top Conviction Ideas: Retail Sector - Q2FY26 Review by Axis Securities