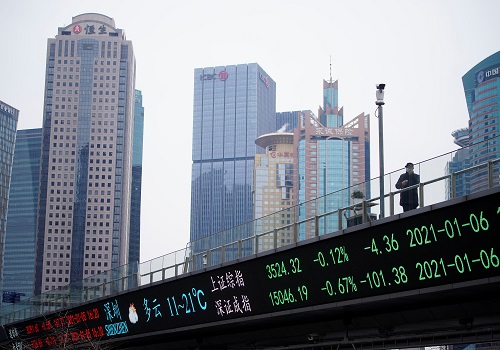

Asia shares skid on China woes, yen hits 6-month high

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Asian share markets slipped on Tuesday amid concerns the rapid spread of coronavirus infections in China would further hurt economic growth and hinder global supply chains, even if opening up would be positive in the long run.

MSCI's broadest index of Asia-Pacific shares outside Japan fell another 1.3%, having lost a fifth of its value last year.

Japanese share trading was shut for a holiday but Nikkei futures were trading lower at 25,655, compared with the last close for the cash index of 26,094.

Chinese blue chips fell 0.8%, while the Hang Seng dropped 2.0%.

Surveys out over the weekend showed China's factory activity had shrunk at the sharpest pace in nearly three years as COVID-19 infections swept through production lines.

"China is entering the most dangerous weeks of the pandemic," warned analysts at Capital Economics.

"The authorities are making almost no efforts now to slow the spread of infections and, with the migration ahead of Lunar New Year getting started, any parts of the country not currently in a major COVID wave will be soon."

Mobility data suggested that economic activity was depressed nationwide and would likely remain so until the infection wave began to subside, they added.

The cautious mood spread to Wall Street, with S&P 500 futures off 0.4% and Nasdaq futures 0.6% lower. EUROSTOXX 50 futures fell 1.4% and FTSE futures 0.8%.

Data on U.S. payrolls this week are expected to show the labour market remains tight, while EU consumer prices could show some slowdown in inflation as energy prices ease.

"Energy base effects will bring about a sizeable reduction in inflation in the major economies in 2023 but stickiness in core components, much of this stemming from tight labour markets, will prevent an early dovish policy 'pivot' by central banks," analysts at NatWest Markets wrote in a note.

They expect interest rates to top out at 5% in the United States, 2.25% in the EU and 4.5% in Britain and to stay there for the entire year. Markets, on the other hand, are pricing in rate cuts for late 2023, with Fed fund futures implying a range of 4.25 to 4.5% by December.

Minutes of the Federal Reserve's December meeting due this week will likely show many members saw risks that interest rates would need to go higher for longer, but investors will be attuned to any talk of pausing, given how far rates have already risen.

While markets have for a while priced in an eventual U.S. easing, they were badly wrong-footed by the Bank of Japan's shock upward shift in its ceiling for bond yields.

The BOJ is now considering raising its inflation forecasts in January to show price growth close to its 2% target in fiscal 2023 and 2024, according to the Nikkei.

Such a move at its next policy meeting on Jan. 17-18 would only add to speculation of an end to ultra-loose policy, which has essentially acted as a floor for bond yields globally.

Japanese 10-year yields have steadied just short of the new 0.5% ceiling, but only because the BOJ stepped in last week with unlimited buying operations.

The policy shift boosted the yen across the board, with the dollar losing 5% in December and the euro 2.3%.

The trend continued on Tuesday as the dollar slid 0.5% to a six-month low of 130.04 yen, having breached major chart support at 130.40. The euro fell to its lowest in three months at 138.32 yen.

The euro was steady on the dollar at $1.0658, after meeting resistance around $1.0715, while the dollar index was holding at 103.760.

In commodity markets, gold was firm at $1,829 an ounce and just short of its recent six-month top of $1,832.99. [GOL/]

Worries about the state of global demand saw oil prices lower. Brent lost 74 cents to $85.17 a barrel, while U.S. crude fell 62 cents to $79.64 per barrel.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">