Stocks drop as central banks meet after 'higher for longer' Fed view

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Global shares slid for a second day on Thursday as major central banks deliver their final policy decisions of the year, with the U.S. Federal Reserve signalling that it expected interest rates to stay higher for longer.

In Europe, the Swiss National Bank delivered an expected half-point hike that brought rates to a 14-year high of 1%.

The franc reversed early losses and rose against the euro as well as the dollar after Chairman Thomas Jordan said the central bank will keep propping up its currency.

Hot on the heels of the Swiss, the Norges Bank raised rates by a quarter-point to 2.75% and indicated it has not finished tightening monetary policy.

And next up is the Bank of England, which is expected to raise rates by half a point to 3.5% at 1200 GMT. Just over an hour later, the European Central Bank will also announce its rate decision.

The MSCI All-World index was last down 0.5%, set for a second straight day of declines, after losses on Wall Street the previous day drove the S&P 500 down 0.6%.

Global stocks have risen by nearly 13% this quarter, marking their strongest quarterly performance for two years, based on the assumption that inflation is gradually subsiding and soon the Fed will indicate it does not need to rapidly raise rates.

"Each time we get cooling inflation data and then the market gets really ahead of itself thinking 'this is going to be the moment that the Fed is going to go dovish' and then they're disappointed," CityIndex strategist Fiona Cincotta said.

"It seems to be a recurring pattern and I would imagine one that's going to continue as we go through Q1 of 2023 as well, so it's a combination of a market getting ahead of itself and some profit-taking, but I don't think it's necessarily the start of an ominous downward trend," she said.

The dollar, which has lost almost 7% in value in the fourth quarter, rose 0.5%, steering clear of this week's six-month lows despite a dip in Treasury yields that would normally depress the currency.

U.S. 10-year yields eased 1 basis point to 3.494%, while those on two-year notes fell by a similar amount to 4.24%, leaving the gap between the two, or "curve", at -75.2 bps.

This inversion reflects concern among investors that higher interest rates could tilt the economy into recession.

In Europe, equities tumbled and bond yields ticked higher. The STOXX fell by 1.2% as heavyweight stocks across sectors sank.

French luxury retailer LVMH, which is highly exposed to the Chinese economy, was the biggest negative weight, down nearly 2%, while Dutch semiconductor manufacturer ASML fell 1.5%.

U.S. e-Mini futures slid between 1-1.3%, suggesting a drop at Thursday's opening bell.

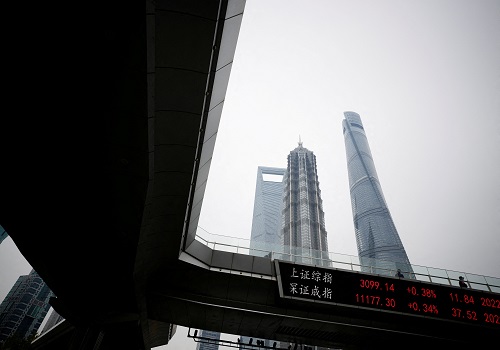

Rising COVID-19 infections and disappointing economic data in China also eroded investor confidence, prompting a decline in crude oil following Wednesday's rally.

Hong Kong's Hang Seng tumbled 1.13% and mainland Chinese blue chips slipped 0.15%.

Fed Chair Jerome Powell said on Wednesday the central bank would deliver more rate hikes next year even as the economy slips towards a recession, arguing that a higher cost would be paid if the Fed does not get a firmer grip on inflation.

The comments followed the Fed's decision to raise the benchmark rate by an expected half a percentage point - down from the recent 75 basis point increases - but projected a terminal rate above 5%, a level not seen since 2007.

Some analysts interpreted the reaction in rates and currency markets as a sign that traders doubt Powell's policy narrative, retaining bets for an early easing of inflation and a Fed pivot soon.

"In essence, the market is still of the view that inflation heads towards target in 2023," Chris Weston, head of research at Pepperstone, wrote in a client note. "The likely result in a potential standoff between the Fed and the markets is volatility."

The euro fell 0.7% $1.0610, but still near Wednesday's more than six-month peak at $1.0695.

Sterling dropped 0.9% to $1.2314, still close to six-month highs.

Crude oil gave back some of Wednesday's 2.5% rally that was driven by forecasts of a rebound in energy demand next year on the back of China reopening after the COVID lockdowns.

China's economy, however, lost more steam in November as factory output slowed and retail sales fell again, hobbled by surging COVID-19 infections and widespread curbs on movement.

Brent crude futures fell 0.8% to $81.98 a barrel after closing Wednesday's session up $2.02, while U.S. crude futures slid 1% to $76.54.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">