Aramco remains in talks with Reliance for partnership

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

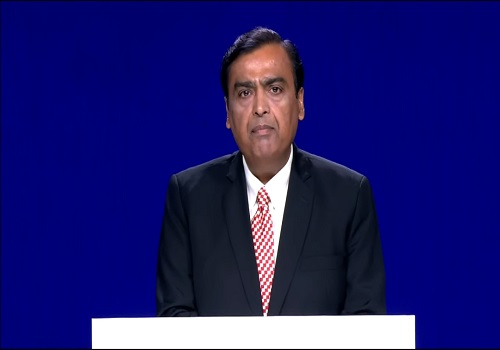

New Delhi, March 23 Saudi Aramco's conference call indicated that it is still in discussion with Reliance to evaluate the existing opportunities as potential partners, regarding the non-binding MoU signed with Reliance for its oil to chemicals (O2C) business.

Morgan Stanley said in a research note that Reliance Industries had recently announced carving out the O2C business as a separate subsidiary to support strategic partnerships and new investors in order to accelerate its new energy and material plans.

"Aramco remains in discussion with RIL for potential partnership. With asset prices, industry outlook, and margins back to August 2019 levels, we see a revival of the earnings upgrade cycle, led by energy. Multiples should surprise positively too as clarity on new energy investments rises," Morgan Stanley said.

"We expect the stake sale discussions to pick up pace - we see valuations and asset prices rebounding to levels seen in August 2019 with a much improved industry outlook," Morgan Stanley said.

In August 2019, RIL announced the agreement on a non-binding letter of intent from Saudi Aramco regarding a proposed investment in its refining, petrochemicals, and fuel marketing business.

"Saudi Aramco's CY20 conference call indicated that its is still in discussion with Reliance to evaluate existing opportunities as potential partners, regarding the non-binding MoU signed with Reliance for its oil to chemicals (O2C) business," the note said.

For Saudi Aramco, Morgan Stanley has projected stronger free cash flow in 2021.

"At the current forward curve for Brent ($62 a barrell for 2021) and taking into account that production levels are likely to improve throughout the year as well, we estimate that operating cash flow will reach $115 billion this year. With capex at the guided level of $35 billion, FCF of $80bn should cover the company's dividend of $75 billion," the note said.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">