All you need to know about Muhurat Trading and its importance

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

With houses decking up and streets buzzing with people, the festive spirit is everywhere. One of the biggest festivals as per the Hindu Lunar Calendar - Diwali - is around the corner. Signifying the triumph of good over evil, Diwali is considered auspicious for new beginnings. Similarly, to mark the start of the new year, the Indian stock market conducts a special session called Muhurat Trading on the evening of Diwali.

So in this write-up, we will walk you through everything that you need to know about Muhurat Trading.

What is Muhurat Trading?

Just like every festival has a unique set of rituals, Diwali has a few too. One of them, as observed by the broking community, is Muhurat Trading. It is a special one-hour session conducted on the evening of Diwali. This Muhurat Trading ritual is considered auspicious to embark on the journey of wealth creation. It is believed that buying stocks during this time brings prosperity for the rest of the year.

Since 1957, BSE has conducted Muhurat Trading every Diwali. NSE joined the league in 1992 right after its launch. This exclusive ritual, observed in the Indian stock market, takes place instead of a regular trading session. The exchanges announce the Muhurat Trading timings every year, and the markets remain closed the next day.

How it all began…

Before the adoption of the current accounting year that starts on 1st April, many followed the traditional method. As per the old system, a new financial year started on the day of Diwali. This is because, according to the Hindu Lunar Calendar, Diwali is considered the start of the new year. Thus, many traders and merchants from Gujarati and Marwari (Baniya) communities followed this system of accounting.

As of today, these traders and merchants are seen performing ‘chopda poojan’ - which denotes worshipping the books of accounts, before entering the first transaction or taking the first trade. Traditionally, it is believed that the first entry in the chopda during muhurat would bring more wealth all year long.

Although the tradition of Muhurat Trading began decades ago, it continues even today. Large participation during this time leads to a strong market trend. Thereby, giving a perfect opportunity for novice investors to enter the stock market. So, if you too are looking to start your journey, then you can do Investing ki Smart Shuruaat with Angel One’s Shagun Ke Shares and make the most out of Muhurat Trading.

Muhurat Trading Session 2022

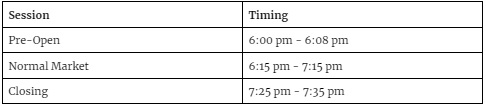

Continuing the tradition, Muhurat Trading will be conducted in 2022 as well. Like a typical trading day, this special session also includes pre-open, normal trading, and closing sessions. The buying and selling orders can be executed in the one-hour time allocated for regular trading.

Here’s a breakdown of 2022’s Muhurat Trading session that is expected to be conducted on 24th October:

Action Plan to Benefit from Muhurat Trading

As discussed, Muhurat Trading is the most auspicious time to buy Shagun Ke Shares. However, it is crucial to conduct due diligence in advance. Before embarking on the journey of investment, you must learn about the basics of the stock market.

Investing in stocks involves performing fundamental and technical analysis of the company and its stock chart. The best platform to gain extensive knowledge about the same is the Knowledge Centre. It is a multidisciplinary hub for modules on stocks, mutual funds, commodities, and cryptos explaining the concepts and strategies.

Now that you are aware of all the essentials of starting the investing journey, you can do Investing ki Smart Shuruaat by taking the first step. Find more about Angel One’s Shagun Ke Shares here.

Disclaimer

This blog is exclusively for educational purposes only. Investments in the securities market are subject to market risk, read all the related documents carefully before investing. Brokerage will not exceed the SEBI prescribed limit. https://bit.ly/2VBt5c5

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">