Agri Picks Daily Technical Report 12 April 2021 - Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

SPICES

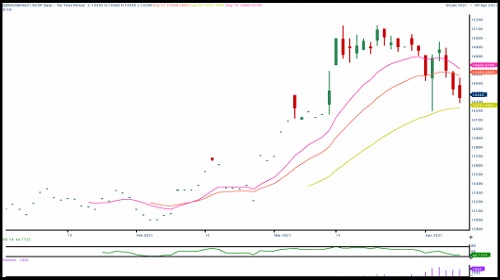

* Jeera May futures on NCDEX continued declining and shed nearly one per cent on Friday. Increasing cases of Covid-19 infections, raising worries over demand and higher arrivals in the spot market weighed on overall market sentiments.

* According to a survey conducted by the Federation of Indian Spice Stakeholders, jeera production in India is likely to be 478520 tons in 2020-21 (Oct-Sep), down by 11 per cent yoy.

* Government estimates 2020-21 jeera output at 887000 tons compared to 912000 tons a year ago.

* According to the second advance estimates released by the Gujarat’s farm department, production in jeera is expected to be at 373700 tonnes in 2020-21 compared to 375420 tonnes produced last year (2019-20).

* According to Gujarat's farm department, as of 28 Dec2020, jeera has been sown across 464469 hectares in state, compared to 435657 hectares sown during the same period last year.

* Spices Board pegs Apr-Sep jeera exports at 153000 tonnes, up by 33 per cent on yoy basis.

* Coriander May futures on NCDEX inched up on Friday on firm demand.

* Government sees 2020-21 coriander output at 720000 tons compared to 701000 tons a year ago.

* Coriander production in Gujarat is expected to rise 55 per cent to 216680 tonnes in 2020-21 season (Jul-Jun) due to sharp rise in acreage according to the state’s farm department’s second advance estimates.

* As of Dec 28, 2020 coriander has been sown across 135563 hectares compared to 76904 hectares sown during the same period last year showed the data from the Gujarat state farm department.

* According to Spices Board of India data, coriander exports for the Apr-Sep period this year is seen at 26750 tonnes, up by nine per cent on yoy basis.

* Turmeric May futures on NCDEX ended Friday’s session in red. In the midst of peak harvest season, worries over demand put downwards pressure on the yellow spice.

* Government sees 2020-21 turmeric output at 1.11 million tonnes compared to 1.15 million tons a year ago.

* Spices Board pegs turmeric export from India for the period Apr-Sep this year at 99000 tonnes, up by 42 per cent year on.

* Government pegs 2020-21 cardamom output at 25000 tons compared to 21000 tons a year ago.

OILSEED

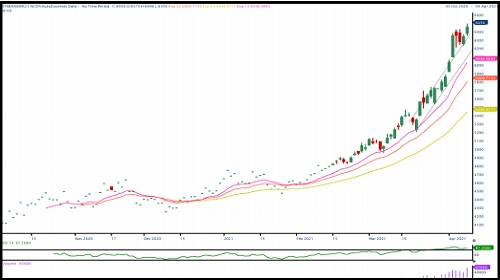

* Mixed sentiments witnessed in the oilseed basket on Friday. MCX Apr CPO prices fell on profit booking along with weakness in BMD Malaysian palm oil prices. May Soy oil prices also witnessed selloffs on profit booking.

* NCDEX May soybean prices extended to trade higher on back of strong demand for soymeal from exporters. May NCDEX Mustard seed prices traded higher on higher demand from crushers.

* India's soymeal exports jumped nearly fourfold on year to 220,000 tn in March, The Soybean Processors Association of India data showed. In the same month a year ago, exports were at 58,000 tn. Overseas shipments of the oilmeal rose significantly due to strong demand from France, Germany, the Netherlands, and Qatar, traders said. During Oct-Mar, exports jumped to 1.59 mln tn from 423,000 tn a year ago, SOPA data showed. Demand for Indian soymeal, which is considered to be rich in protein and is non-genetically modified, is seen rising in the world markets, the traders said.

* Sri Lanka's decision to ban import of crude palm oil is unlikely to impact global prices, market experts said. Sri Lanka buys palm oil in small quantity and its decision to stop the import is unlikely to lead to a global glut.

* India's soymeal exports in March are expected to jump sixfold on year to nearly 200,000 tn, according to SEA.

* Crushing of mustard seeds rose 60% on year to 1.2 mln tn across the country in March, data from Marudhar Trading Agency showed. Mills had crushed 750,000 tn of the oilseed during the same period last year.

* India's 2020-21 (Jul-Jun) mustard output is seen rising to 22.6% on year to 8.95 mln tn, according to a joint survey by the Central Organisation for Oil Industry and Trade and the Mustard Oil Producers' Association. India's oilmeal exports surged threefold on year to 393,309 tn in February, as per data released by The Solvent Extractors' Association of India. For Apr-Feb, overall exports of oilmeal rose 49% on year to 3.36 mln tn. India's vegetable oil imports dropped nearly 25% on year to around 838,607 tn in February, The Solvent Extractors' Association of India said. During Nov-Feb, the country imported 4.39 mln tn of vegetable oil, down 3.7% from the year-ago period.

* The US Department of Agriculture has scaled up its estimate for global oilseed production in 2020-21 to 595.8 mln tn from 595.1 mln tn projected in February. The world oilseed crop is projected higher with rise in production of soybean and rapeseed, a kind of mustard. Soybean output in Brazil was raised by 1 mln tn to 134 mln. Soybean output is raised 200,000 tn to 10.7 mln in India based on updated government area data while Argentina’s soybean crop is reduced 500,000 tn to 47.5 mln due to dry weather conditions over the past month. The agency said that a sharp rise in world oilseed production was limited by lower palm kernel, cottonseed, and sunflowerseed output. World oilseed exports are raised 800,000 tn to 194.7 mln tn primarily on higher rapeseed exports for Ukraine and Australia. World soybean crush is forecast up 1.6 mln tn to 323.6 mln as higher crush for Argentina and Brazil is partly offset by lower crush for China. Higher crush in Argentina results in higher meal and oil exports. Soybean crush for China is lowered by 1 mln tn to 98 mln tn. World soybean stocks are a tad higher, with increased stocks for China and Brazil that are mostly offset by lower stocks for Argentina, it said.The agency maintained its estimate for soybean output in the US at nearly 112.6 mln tn in 2020-21.

* India is likely to produce around 10 mln tn of mustard in 2020-21 (Jul-Jun), up 35% from a year ago, due to higher acreage and favourable weather conditions, according to the Solvent Extractors' Association of India.

* The government has proposed agriculture infrastructure and development cess on key edible oils in the Union Budget for 2021-22 (Apr-Mar). In the case of crude palm oil, the cess would lead to rise in overall effective duty by 5.5 percentage points to 35.75%. No major changes is seen in effective crude soyoil duty and crude sunflower oil.

* As on Dec 31, farmers, processors, stockists and state-run agencies had around 400,000 tn stock, compared with nearly 1.2 mln tn a year ago, according to Mustard Oil Producers Association of India.

* Farmers in the country have sown mustard across 6.9 mln ha, up 10.6% on year, in 2020-21 (Jul-Jun) season so far, data from the farm ministry.

* Indian government slashed import duty of crude palm oil. The government cut import duty on crude palm oil by 10% to 27.5%, in the last week, to cool off soaring edible oil prices in domestic markets.

* The area under major kharif crops so far in 2020-21 (Jul-Jun) was at 111.7 mln ha, up nearly 5% from a year ago, farm ministry data showed. The area under soybean across the country rose 6.4% on year to 12.12 mln ha as of 24th Sep, according to data from the farm ministry. The Union Cabinet approved a hike in minimum support price for 14 major kharif crops. MSP for soybean hiked by Rs.170 to 3880 from 3710 per 100 kg. Soybean output is estimated at 12.2 mln tn in 2019-20, according to the farm ministry's fourth advance estimate.

* India is likely to grow a record 10 mln tn mustard crop in 2020-21 (Jul-Jun), mainly due to the likelihood of a sharp rise in acreage, according to Solvent Extractors' Association of India. The government has targeted an alltime high crop of 12.5 mln tn for this rabi season. The government has fixed the minimum support price at 4,650 rupees per 100 kg for 2020-21 (Apr-Mar) marketing season against 4,425 rupees per 100 kg the previous year.

* According to the first advance estimates for 2020-21 (Jul-Jun), castor seed output is seen at 1.7 mln tn compared with 1.8 mln tn in the fourth advance estimates for 2019-20, according to the data released by the farm ministry. While, according to traders, crop is seen at 1.5-1.6 mln tn. Farmers have sown castor seed across 792,000 ha in 2020-21 (Jul-Jun), down 16% from a year ago.

* India's castor oil exports fell 5.2% on year to 43,516 tn in February, according to data from Solvent Extractors' Association of India. A year ago, exports were at 45,900 tn.

* Malaysia's crude palm oil output fell 1.9% on month to 1.1 mln tn in February, data from Malaysian Palm Oil Board showed. Total palm oil stocks in the country declined 1.8% on month to 1.3 mln tn. Exports of palm oil in February declined 5.5% on month to 895,556 tn, and those of biodiesel rose over 179% on month to 28,206 tn.

* Malaysia's palm oil exports rose 28% on month to 1.3 mln tn in March, according to cargo surveyor AmSpec Agri Malaysia.

Cotton

* The International Cotton Advisory Committee has scaled up its forecast for global prices in 2020-21 (AugJul), as ending stocks for the ongoing season are estimated to be lower. The committee has revised upwards its price forecast for Cotlook A index, a global benchmark for prices of raw cotton, by 3 cents from the previous month to 79 cents per pound. Lower stock levels provide additional support for prices which have increased over the course of the current season supported by falling production and rising consumption. Global ending stocks for the season are estimated at 20.9 mln tn, compared with 21.4 mln tn in the previous season. Global production for the ongoing season is estimated at 24.1 mln tn, down 8% from the previous season. The fall has largely been attributed to a smaller crop in the US, Brazil, and Pakistan. Production in India, is expected at 6.3 mln tn, compared with 6.2 mln tn in the previous year. In the US, cotton production is estimated at 3.2 mln tn, against 4.3 mln tn a year ago. The committee has estimated global consumption at 24.5 mln tn, compared with 22.8 mln tn last year as manufacturing activity continues to show signs of recovery. Global exports are seen higher at 9.5 mln tn, compared with 9.0 mln tn a year ago.

* The UK-based Cotton Outlook has marginally lowered its estimate for global output in 2020-21 (Aug-Jul) by 85,000 tn to 24 mln tn in its March report. The estimate has been scaled down largely because production is expected to be lower in India and the US. Output is seen higher at 6.3 mln tn in China. For the current season, the agency has lowered its crop estimate for India, the largest producer, to 6.1 mln tn from 6.2 mln tn projected a month ago. Production in the US is seen at 3.2 mln tn. Global cotton consumption in 2020-21 is seen at 24.9 mln tn, against the 24.5 mln tn projected in the previous month. Consumption is seen marginally higher on likely rise in demand from the Indian subcontinent, China and Turkey. As textile supply chains have recovered following the most acute phase of the COVID-related disruption, many spinners have enjoyed good profits and some have been adding new capacity. Ending stocks of the fibre for 2020-21 are seen at 814,000 tn, against 417,000 tn projected last month.

* The Cotton Association of India has marginally lowered its production estimate to 35.9 mln bales for the year from 36.0 mln bales in 2019-20. Of the total crop, around 29.9 mln bales have arrived in markets across India till February. The Cotton Association of India has raised its export estimate for the ongoing 2020-21 (Oct-Sep) season to 6.0 mln bales (1 bale = 170 kg) from 5.4 mln bales projected in the previous month. In the current marketing year till February, India has shipped around 3.6 mln bales. The association has scaled down its estimate for ending stocks to 10.6 mln bales, against 11.5 mln bales projected a month ago. Domestic consumption is maintained at 33.0 mln bales in 2020-21, while imports are now pegged at 1.2 mln bales compared to 1.4 mln bales a month ago. The US Department of Agriculture has scaled down India's cotton ending stock estimate for 2020-21 (AugJul) to 17.4 mln bales (1 US bale = 218 kg) from 18.1 mln bales pegged in February. The downward revision in stocks is mainly due to higher export estimate for the country. On the export side, higher Indian exports account for most of the increase as auctions by the Cotton Corp of India have released much of the cotton purchased last year under the minimum support price. The agency, in its World Agricultural Supply and Demand Estimates report for March, revised its export estimates for India to 5.7 mln bales from 5.0 mln bales in the previous month. Production and domestic consumption estimate for India is maintained at 29.0 mln bales and 24.3 mln bales, respectively. USDA has scaled down its global cotton production estimate for 2020-21 to 113.3 mln bales due to smaller crop in Brazil and the US. The agency had pegged global production at 114.1 mln bales a month ago. Global cotton consumption is seen marginally higher at 117.5 mln bales. Exports are now seen at 44.5 mln bales, compared with 43.9 mln bales. Ending stocks are expected to be lower at 94.6 mln bales compared with 95.7 mln bales.

In the Union Budget for 2021-22 (Apr-Mar), Finance Minister Nirmala Sitharaman proposed customs duty of 5% on cotton and 10% on cotton waste. She also proposed an Agriculture Infrastructure and Development Cess of 5% on cotton, taking the overall customs duty to 10%. Customs duty on raw silk and silk yarn or yarn spun from silk waste has been increased to 15% from 10% earlier.

* The area under major kharif crops so far in 2020-21 (Jul-Jun) was at 111.7 mln ha, up nearly 5% from a year ago, farm ministry data showed. Farmers have sown cotton across 13.04 mln ha in the 2020-21 (JulJun) season, up by 2.1% from a year ago, as of 25th Sept., farm ministry.

* India's cotton output in the 2020-21 (Oct-Sep) marketing year is seen at 38.0 mln bales (1 bale = 170 kg), up 4% on year, according to traders' pegs 2020-21 cotton crop at 37.1 mln bales vs 35.5 mln bales.

* Govt cuts 2019-20 cotton output view to 35.5 mln bales vs 36.0 mln. The government has raised the support price of medium staple cotton by 260 rupees per 100 kg to 5,515 rupees, and that of long staple by 275 rupees to 5,825 rupees.

OTHERS

* Chana May futures on NCDEX climbed to a 6-months high on Friday on robust demand for the pulse.

* Procurement of chana under the price support scheme has more than doubled 124130 tons in less than 10 days according to government officials.

* The government has procured 58819 tn of chana, harvested in 2020-21 (Jul-Jun), from farmers at the minimum support price as of March 22.

* Rajasthan government will start procurement of chana and mustard from farmers at the minimum support price from April 1. Around 614900 tons of chana and 1.2 million ton mustard will be procured from the farmers.

* The government has approved procurement of 14350 tons of chana Bihar during 2021- 22 rabi marketing season.

* The farm ministry has approved the procurement of 61000 tonnes of chana from Maharashtra in 2021-21 under the price support scheme according to the NAFED.

* The farm ministry has approved the procurement of 51325 tonnes of chana from Telangana in 2021-21 under the price support scheme according to the NAFED.

* Farm Commissioner expects 2020-21 chana output to be at 11.5 million tonnes compared to 11.4 million tonnes a year ago.

* India’s guar gum exports improved in the month of December 2020 by 32% to 17,644 tonnes compared to 13,414 tonnes during November 2020 at an average FoB of US $ 1849 per tonne in the month of December compared to US $ 1611 per tonne in the month of November 2020. However, the gum shipments were down -1% in December 2020 compared to the same period last year. Of the total exported quantity, around 4,914 tonnes is bought US, Russia (3,290 tonnes) and Germany (2,432 tonnes).

* India’s guar split exports fell in the month of December 2020 by -39% to 2,800 tonnes compared to 4,557 tonnes during November 2020 at an average FoB of US $ 955 per tonne in the month of December compared to US $ 1,390 per tonne in the month of November 2020. Further, the guar split shipments were up +32% in December 2020 compared to the same period last year. Of the total exported quantity, around 1,880 tonnes is bought China, US (800 tonnes) and Switzerland (120 tonnes).

* Weak cues from the overseas market coupled with concerns over demand dragged down natural rubber prices on MCX for the fourth straight session on Friday. Quotes for RSS4 grade rubber in the spot market dipped as well.

* Based on the preliminary estimates, the outlook of world production of natural rubber (NR) is likely to fall 12.4%, year-on-year, to 897,000 tonnes in February 2021. While the world consumption of natural rubber is estimated to recover at 47.5%, year-on-year, to 1.103 million tonnes during the same month too.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at www.geojit.com

SEBI Registration number is INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">