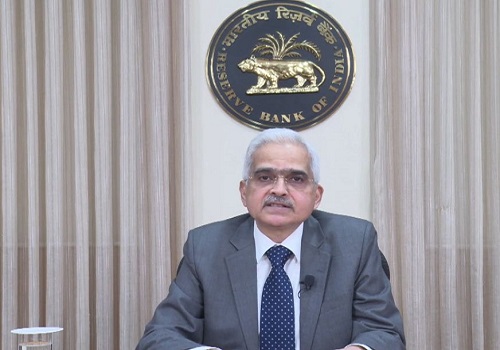

Accurate, analytical audit reports essential for financial stability, growth: RBI Governor

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Reserve Bank Governor Shaktikanta Das has said that accurate and analytical audit reports are essential for financial stability and growth as they instil confidence among members of the public. He said in case of the public sector, auditing is a cornerstone of good governance. He stated ‘By providing unbiased and objective assessments of whether public resources are managed responsibly and effectively to achieve the intended results, a fair and impartial audit instils confidence among citizens and stakeholders’.

Observing that fair and impartial audit in a globally integrated economy is not just a domestic concern, he said, it also an instrument to enhance the country’s reputation and credibility on a global stage. He said ‘with increasing complexity of financial markets and higher expectations from the public about efficient resource allocation, the role of audit has become even more important’. He also said ‘as India aspires to grow faster, the expertise and independence of auditors will have to be leveraged to provide more assurance on financial performance to all stakeholders. We need robust audit for a dynamic and resilient economy’.

Noting that economic decisions are increasingly made based on available evidence and information, he said, inaccurate data may lead to sub optimal decisions or excesses in resource allocation, which will be neither in public interest where public authorities are involved, nor in the interest of individual stakeholders. Citing an example of the banking sector, the governor said if a bank sanctions loan on the basis of inaccurate and misleading financial statements, the borrower company is ultimately unable to repay it. Apart from the loss incurred, he said, this could make the bank risk averse and deprive other eligible companies from bank funding. Alternatively, he said, the bank may try to recover this loss by charging an interest rate to other borrowers, thus resulting in sowing seeds of non-viability in such borrowers. This would create a situation of higher interest cost to the overall economy and the society.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">