A sustained bull run needs low valuations and steadily improving growth and earnings prospects Says Dr. V K Vijayakumar, Geojit Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Quote On Morning Market 05 July 2023 By Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

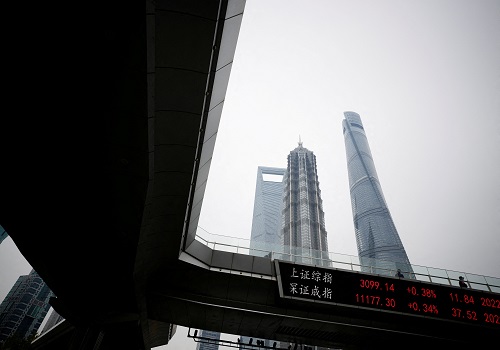

The 15 % surge in Nifty from the low levels of March has given a bullish flavour to this rally; but it is difficult to describe this as a bull market since valuations do not permit a sustained rally and the evolving economic fundamentals do not warrant continuation of the rally much beyond the current levels.

A sustained bull run needs low valuations and steadily improving growth and earnings prospects. Valuations are not favourable now and growth and earnings prospects, though good, are not very bright. For instance, the June auto sales numbers came below expectations and indicate that sluggish demand remains a problem, particularly for price sensitive mass consumption products. The economic recovery continues to be ‘K’ shaped as indicated by the resilient demand for premium products.

There is valuation comfort in financials, particularly the leading private sector banks. Leading PSU banks are attractively valued compared to their private sector peers. FY24 Q1 results of the banking majors will be good.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Market Quote : The market already remains sensitive to FIIs selling Says Mr. Vinod Nair, Geo...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">