India continues to remain stable; Government`s boost to consumption likely to benefit economy: Motilal Oswal Private Wealth

According to March 2025 Alpha Strategist Report by Motilal Oswal Private Wealth (MOPW), Equity markets remained in the correction zone during Feb' 25 with selling witnessed across the market segments. Amid the continuation of uncertainty due to various factors like imposition of tariffs by US, measures deployed by China to revive its economy, and stronger dollar; markets are likely to remain in such corrective/consolidation phase in the near future as well. Corporate earnings for Q3 also failed to revive the sentiment, however Q3FY25 GDP showed some signs of recovery in economy.

MOPW believes clarity on these fronts to emerge gradually and markets are likely to factored in all during first half of the year from longer term perspective, India continues to remain stable and a growing economy. MOPW believes that recent announcements by the govt to boost the consumption are also likely to further benefit the economy. Due to the correction, valuation of large caps (Nifty 50) has come below the 10-yr average on 1 year forward PE basis, while mid and small caps still trade at decent premium.

During the current phase, it is advisable to tread with caution by adopting a strategy which is balanced and resilient. Based on their risk profile, investors having the appropriate level of Equity allocation can continue to remain invested.

Considering the recent corrections, if Equity allocation is lower than desired levels, investors can increase allocation by implementing a lump sum investment strategy for Hybrid & Large Cap funds and Staggered approach over the next 6 months for Flexi, Mid & Small cap strategies with accelerated deployment in the event of a meaningful correction.

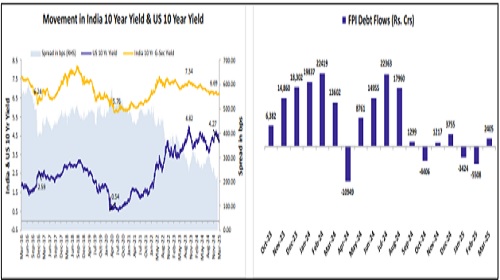

FPI Flows in India

FPI flows in India has been muted in last 6 months on back of higher US treasury yields, stronger dollar & reduced differential in US/India yields.

Source – RBI, Internal Research

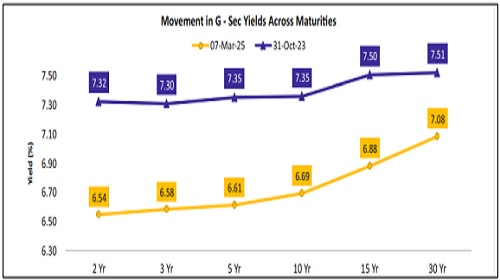

India G - Sec Yield Curve

Since Oct 2023 onwards, yield curve has shifted downwards on back of favorable demand supply dynamics, well contained inflation and stable domestic macros. Since Oct 2024, global and domestic factors have created interim volatility restricting the yields from falling further.

Fixed Income View & Portfolio Strategy

With the evolving interest rate scenario, MOPW believes the duration play is in its last leg and long term yields to remain higher for longer and hence duration can be exited fully. Actions by RBI on rate cuts and liquidity, are likely to result into steepening in yield curve. We recommend fixed income portfolio to be Overweight on Accrual Strategies.

* Accrual can be played across the credit spectrum by allocating 45% – 55% of the portfolio to Performing Credit & Private Credit Strategies, InvITs & Select NCDs

* 30% – 35% may be invested in Performing Credit Strategies/NCDs and InvITs

* 20% – 25% may be invested in Private Credit including Real Estate/Infrastructure strategies and select NCDs

* 25% - 35% of the portfolio may be invested in Arbitrage Funds (minimum 3 months holding period), Floating Rate Funds (9–12monthsholdingperiod), Absolute Return Long/Short strategies (minimum12-15monthsholdingperiod)

* For tax efficient fixed income alternative solutions, 20% - 25% of the portfolio may be allocated in Conservative Equity Savings funds (minimum 3 years holding period)

View on Gold Market

Gold market is shaped by central bank buying, price surges, and geopolitical uncertainties. While tariff concerns have caused shifts in trading behavior, the market's depth and liquidity are expected to absorb most of these shocks over time. Demand patterns vary across regions, with China and India showing unique trends in wholesale demand, ETF flows, and consumer sentiment.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)