F&O Rollover Report by Axis Securities Ltd

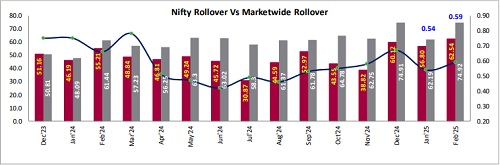

The Nifty February rollover reached 62.5% on Tuesday, an increase from 56.8% during the last expiry. This surpasses the three-month average of 51.9% and the six-month average of 49.5%. The rollover cost for February increased to 0.59% on Tuesday, compared to 0.54% on the same day in the previous expiry, indicating higher cost associated with this month's rollover. Bank Nifty’s February rollover stands at 58.2% on Tuesday, slightly down from 59.8% in the last expiry; it remains below the three-month average of 59.9% but exceeds the six-month average of 56.5%. The market-wide February jumped to 74.9%, a significant rise from 62.2% on the corresponding day of the last expiry. This figure surpasses the three-month average of 67.5% and the six-month average of 64%. The option data for the February series indicates a strong Call Open Interest (OI) at the 22,700-strike price, followed by 23,000. In contrast, a substantial concentration of Put OI is observed at 22,600, with additional levels at 22,500. This suggests the likely range for the current expiry is between 22,500 and 23,000.

Nifty Rollover Vs Market wide Rollover

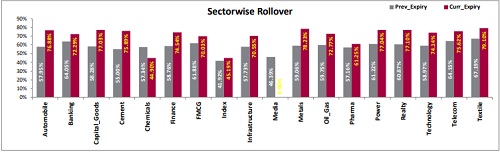

Stock & Sector Highlights

* MUTHOOTFIN, MAXHEALTH, APLAPOLLO, PNB, and ZOMATO recorded a higher rollover on Tuesday than the previous expiry's corresponding day.

* WIPRO, TVSMOTOR, IDFCFIRSTB, SUPREMEIND, and DELHIVERY saw a lower rollover on Tuesday compared to the day of the former expiry.

* The highest rollover during the current expiry for the day is noticed in GODREJCP, DMART, TVSMOTOR, CROMPTON, and PETRONET.

* The lowest rollover in the present expiry for the day is seen in MANAPPURAM, CYIENT, IRCTC, BERGERPAINT, and LUPIN.

Sector-wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Opening Bell : Benchmarks to make cautious start amid mixed global cues