Silver prices are expected to take cues from gold prices and may slip towards - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

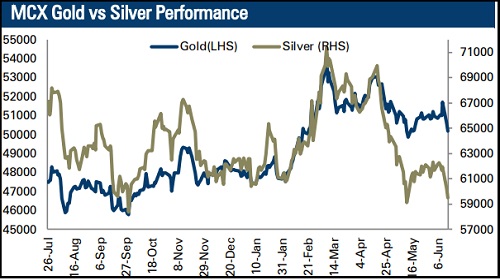

Bullion Outlook

• Comex gold prices declined almost 1.0% on Tuesday amid a surge in US dollar index and on elevated 10 year bond yields

• Moreover, prospect of further monetary tightening by the US Fed to cool down rising inflation weighed on precious metal prices

• However, disappointing macroeconomic data from the US and risk aversion in global markets continued to support bullion prices on the lower side

• MCX gold prices are expected to slip further towards | 49,800 for the day primarily due to elevated dollar index

• Silver prices are expected to take cues from gold prices and may slip towards | 59,000 levels for the day. Additionally, investors will remain cautious ahead of interest decision from the US

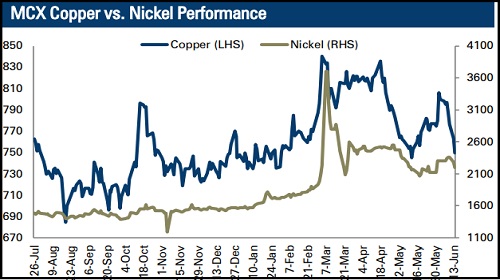

Base Metal Outlook

• MCX Copper and other industrial metal prices slipped on Tuesday as investors were concerned that renewed lockdowns in China and a potential global recession could slash demand for metals

• Further, a sharp rise in LME copper inventories coupled with elevated dollar index continued to pressurise copper prices on the higher side

• Argentina said on Monday it would introduce a new optional tax regime for copper producers that could potentially lower export duties in an effort to jumpstart national production

• MCX copper prices are expected to trade with a negative bias due to concerns over lower industrial metal demand. It is trading below support levels of 200 DMA, which is around | 762. As long as it sustains below this level, it is likely to correct towards | 738 levels for the day

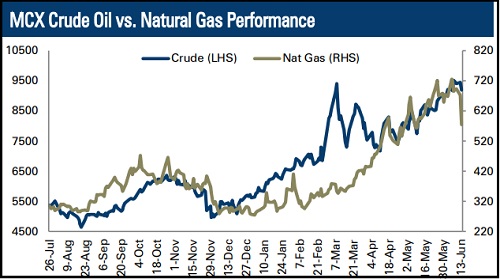

Energy Outlook

• WTI crude oil prices traded flat on Tuesday on investor concerns over tight supply. Tight supply has been aggravated by a drop in exports from Libya amid a political crisis that has hit output and ports

• Opec+ countries maintained their forecast that world oil demand will exceed pre-pandemic levels in 2022 but said Russia's invasion of Ukraine and developments related to the Coronavirus pandemic pose a considerable risk

• Natural gas prices slipped after LNG shipping facility in Texas said a fire last week would knock out facility until late this year, reducing export capacity

• MCX crude oil prices (July Futures) are expected to trade in the consolidation range of | 9,050 to | 9,400 for the day on expectation of decline in US crude oil stock piles. However, concerns over slowdown in global economic growth will continue to hurt oil prices

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">