Power Infra Sector Update - March 2022 power generation 3yr CAGR at 6%; Apr’22 (1-4 th) 3 year CAGR slows to 3% By JM Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Mar’22 power generation 3yr CAGR at 6%; Apr’22 (1-4 th) 3 year CAGR slows to 3%

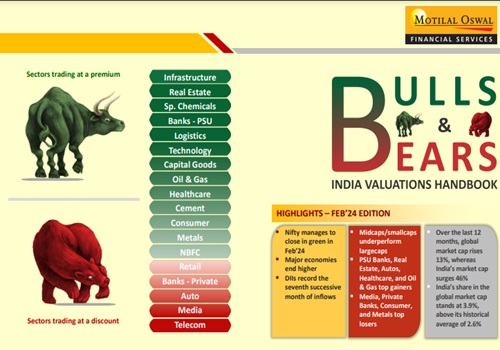

On a 3 year CAGR basis (since FY20/21 have low base on Covid impact), power demand grew 6% from Mar’19-Mar’22 (Exhibit 1-2) vs 3% growth in Jan’22 / Feb’22 - due to rising air conditioning demand from heat waves in North/West India in Mar’22 (media article), coupled with 100% industrial /commercial activity (relaxation of Covid restrictions). The 1 st - 4 th Apr’22 power demand growth however has cooled off to 3% (3 yr CAGR). This comprises 5-6% CAGR in North/West while demand in East/South grew by 3% / -1%. Median peak demand recovered to pre-Covid levels of 198GW in Mar’22 vs. April’20 lows of c. 135GW.

NPTC’s plant coal stocks (Exhibit 46-47) remain healthy in Mar’22 at 13-14 days (vs. bottom of 5days in Oct’21). The current stocks are 16 / 11 days at pit-head / non-pithead plants. As a result, NTPC’s plant PAFs expanded to 91% in Feb’22 vs 81% in Oct’21 implying recovery of fixed costs for full year FY23, as indicated in their 3Q con call. We remain bullish on NTPC in the power space given steady growth; improving receivables and transition to renewables (see 3Q FY22 report). All India power plant coal stocks remain healthy at 9-10days (Exhibit 43).

Merchant & Coal Prices: IEX prices touched a peak of INR 19/kWh in Mar’22 (average in Mar’22 – INR 8.1/kWh) on rising power demand and lower PLFs of imported coal / gas based plants(unviable at current coal/gas prices (Exhibit 39). Given the high volatility of prices CERC has caped IEX prices at INR 12/kWh (implied generation cost of INR 10-11/kWh firing imported coal at $200/T).

Coal India’s (CIL) Mar’22 CIL off-take / production grew by 1.4%/0.5% (3 year CAGR) while coal imports fell 58% YoY in Feb’22 given the rise in imported coal prices (Exhibit 39). However future coal imports are expected to grow as CEA has advised all power plants in the country to blend imported coal (link) to overcome any seasonal power crisis as seen last year (see report)

Imported coal prices have sky rocketed to $203/T in Mar’22 while Indonesia has set the April’22 benchmark at $288/T (vs. $45/Tonne in Jul’20). At $ 300/T coal cost we estimate power tariffs of c. INR 13/kWh (with 15% RoE), vs current merchant price cap of INR 12/kWh– implying most imported coal based plants may again shut down in April’22. However, Mar’22 saw imported coal based merchant players (like JSW Energy) benefit from peak prices of INR 18/kWh though for a short time span. Tata Power benefits from coal prices higher than $ 130-135/T when coal profits more than UMPP losses (assuming full shutdown) - see detailed report.

Discom dues (Exhibits 33-37): have again ballooned to past peaks of INR 1.3trn (5.2x monthly bill) in Mar’22. However dues to NTPC remain low at INR 55 bn (-77% from peak of Sept’20; Exhibit 37). Maharashtra, Rajasthan, Tamil Nadu (TN), UP and Karnataka comprise 58% of overall dues

L&T: While 4Q order inflows could surprise positively and execution is on track to meet 13-15% YoY growth, we find meeting FY22 EBITDA margin guidance of 10.3% to be suspect. With commodity cost inflation impacting 9M FY22 margins (fixed cost contracts at ~35% of OB), we fear margin pressures may continue into 4Q / FY23. However with a robust OB of 3.6x EPC sales, and INR 3.9trn prospect pipeline, we remain bullish on inflows/ execution growth. While margin pressures are expected to ease by 4Q FY23/FY24 as fixed price contracts will get fully executed. We remain positive on L&T and estimate 26% EPC profit CAGR over FY21-24 (report link).

NHAI has outlined highway projects worth ~INR 6trn (to be awarded by FY24 for completion by FY26). This implies an annual awarding target of 5,000-6,000km over FY22-24 (vs. 4,788km in FY21). Till 3QFY22, ~2,000km worth ~INR 1trn have already been awarded, signifying strong order pickup (>2500 km) in 2HFY22 (report link)

Road sector Despite good EBITDA growth (average +15% YoY), the 3Q FY22 PAT growth was flattish for KNR, lower by 11% YoY for ABL while for GR Infra the 5% YoY fall in Adj PAT is led by 16% YoY fall in EBITDA partly negated by lower taxes. Most road EPC players have maintained their FY22 EBITDA margin guidance (PNC 13.5%, GR Infra 16-17%, ABL 11- 11.5%) while KNR has raised guidance to 19-20%. We reiterate BUY on PNC, KNR and ABL (inexpensive valuations); HOLD on GR Infra. (see detailed report).

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.jmfl.com/disclaimer

CIN Number : L67120MH1986PLC038784

Above views are of the author and not of the website kindly read disclaimer

More News

Auto Sector Update - 2W dealer checks: demand revival in upcoming festivals By JM Financial