MCX gold prices are expected to trade with a positive bias for the day - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

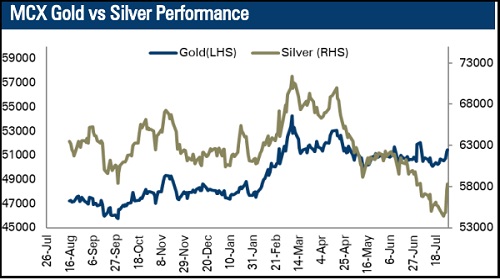

Bullion Outlook

• Comex gold prices advanced almost 0.72% on Friday amid decline in US 10 year treasury bond yields and a weak US dollar

• At the same time, growing concerns over rising inflation and geopolitical uncertainty boosted demand for bullion prices

• However, strong economic data from the US prevented further gains. Core PCE prices index in the US, rose 0.6% MoM in June 2022, following a 0.3% increase the previous month and slightly above market expectations of 0.5%

• MCX gold prices are expected to trade with a positive bias for the day amid weakness in US dollar index. It is likely to continue its upward trend towards the level of | 51,780 in coming session

• Silver prices are expected to take cues from gold prices and may rally towards | 59,360 levels for the day

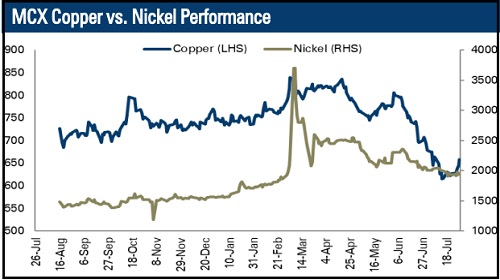

Base Metal Outlook

• Comex copper and aluminium prices edged higher on Friday due to hopes of demand recovery in top consumer China

• Further, copper prices were supported after miner and trader Glencore on Friday cut its full year copper guidance and said total copper production fell 15% to 510,200 tones in the first half of this year

• Moreover, the Chilean state miner Cadalco reported it produced 736,000 tones of copper between January and June of 2022, a 7.5% fall compared to the first half of 2021, supported copper prices

• MCX copper prices are expected to trade with a positive bias for the day amid sharp drop in copper LME warehouse inventories. It is likely to trade in the range of | 655 to | 675 in coming session

• Additionally, investors will remain cautious ahead of Manufacturing PMI data from the US

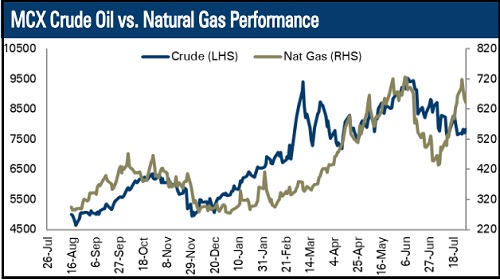

Energy Outlook

• WTI crude oil prices advanced almost 2.28% on Friday as attention turned to next week's Opec+ meeting and dimming expectations that the producer group will imminently boost supply

• At the same time, according to a monthly report from the US Energy Information Administration, US crude oil production slid in May by about 0.5% to its lowest since February

• Moreover, crude oil prices were supported as report showed Opec+ group produced almost 3 million barrels per day less crude than foreseen by its quotas in June due to sanctions on some members

• MCX crude oil prices are expected to trade with a positive bias for the day due to expectations of lower production from Opec+ countries. It is likely to continue its upward move towards the level of | 8150 in coming trading sessions

• Additionally, MCX natural gas prices are expected to trade towards the level of | 674 in coming session

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">