Fixed Income House View- August 2021 by Tata Mutual Fund

RBI OBJECTIVES AND ACTIONS

RBI OBJECTIVES

Foster economic growth over the coming financial year while keeping a close watch on inflation. RBI is expected to give priority to growth over CPI inflation.

RBI stated its intention to ensure orderly evolution of the G-Sec curve & reduce volatility to ensure a stable rate structure

RBI is expected to support the government borrowing program. In mid-July, the government announced borrowing would remain unchanged in the first half of FY2021-22

Intervene through various measures (OMO/G-SAP, Operation Twist) to control upward movement in yields

RBI AND GOVERNMENT ACTIONS

RBI Interventions

RBI announced that it would use the ‘uniform pricing auction’ method in place for all benchmark securities, barring 30Y & 40Y benchmark papers which will have multiple price-based auction.

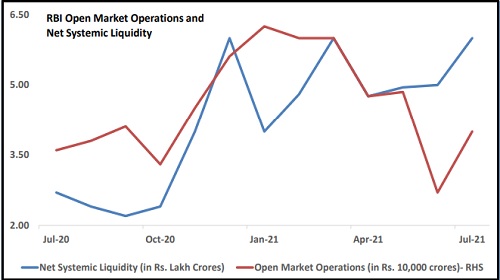

RBI purchased G-secs worth Rs.40k crores through OMOs, with a Rs. 20,000 crores tranche on 8-July and another tranche of Rs.20,000 crores on 22nd July. Spreading the OMO tranches throughout the month somewhat helped to maintain yield levels.

Yield increased in 10 years Government securities even with issuance of new 10-year benchmark which quickly came to discounted price after the issuance. Shorter end of the segment also saw marginally better levels as T-bill borrowing for given quarter was significantly less for respective segments compared to previous quarter.

Rs. 75,000 crores will be transferred from the government to the states as GST compensation. This helped G-Sec yields, especially in the 1–5-year segment.

RBI ACTIONS AND SYSTEM LIQUIDITY

Economic data is expected to sequential improve in the coming months allowing for partial withdrawal of excess liquidity in the system.

Liquidity in the system is around 6 Lakhs crores and is expected to increase in the coming months as RBI takes delivery of its dollar forward purchases.

RBI POLICY ACTIONS

RBI cut its headline policy rates significantly in May-2020 to provide liquidity to banks to boost lending and encourage economic growth during the pandemic

RBI is expected to continue to re- iterate its accommodative monetary policy stance. As against pre phase II expectations of rate hikes staring Sept – Dec 2021, we now expect RBI to stay on hold for this Calendar Year.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer