Within few minutes of trade, Nifty moved towards 18100 - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

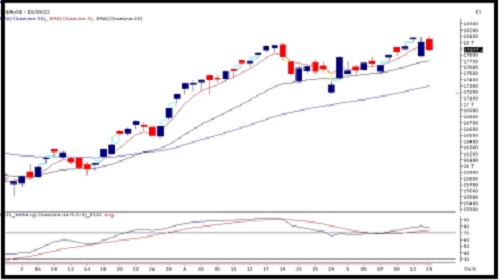

Sensex (59934) / Nifty (17877)

Wednesday’s dramatic session was followed by a pleasant start yesterday morning. Within few minutes of trade, Nifty moved towards 18100 and meanwhile the banking index just hastened to register a new high of 41840.15. It looked like as if we are going to have a great weekly expiry yesterday. But as mostly market surprises every now and then, we witnessed a sharp profit booking thereafter to not only pare down gains but also slipped well inside the negative territory. With some volatile swings in the latter half, the Nifty eventually concluded the weekly expiry with a cut of seven tenths of a percent, tad below the 17900 mark.

Yesterday’s profit booking in BANKNIFTY was no surprise to us; but the way it closed at the lowest point of the day, was a bit unexpected. This price development should be construed as merely a profit booking in key indices. But next couple of sessions would be quite important in order to maintain the recent positivity. As far as Nifty is concerned, Wednesday’s low of 17770 would be seen as a pivotal point and till the time, we are able to defend it, there is no reason to worry for. On the flipside, 17950 followed by 18100 are to be considered as immediate hurdles

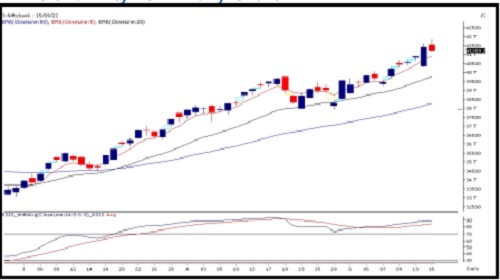

Nifty Bank Outlook (41209)

After a flat start, Bank Nifty immediately witnessed a follow-up move to the previous session run, and within the first half an hour itself, the Bank Index marked a fresh new high. The excitement for this new achievement was however short-lived as we witnessed profit booking during the remaining part of the session to eventually end with a cut of 0.47% tad above 41200.

In line with our expectations, the bank index marked a fresh new high yesterday however after achieving this target we saw some profit booking and it was obvious after the sharp up move seen from the Wednesday's swing low the intraday indicators were highly overbought. The undertone remains bullish however since the initial target has been achieved and considering yesterday's sluggishness after marking a fresh new high; one needs to be watchful for the next few sessions. Ideally going with the primary uptrend, one should remain with the recent strategy of buying on dips with strong support placed at Wednesday's low around 40300 whereas for the momentum to trigger again prices need to see a sustained close above 41900 levels. Immediate supports to consider for buying on dips would be in the range of 40750 - 41000.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One