The real action was seen outside the index as many individual stocks witnessed mesmerizing moves - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

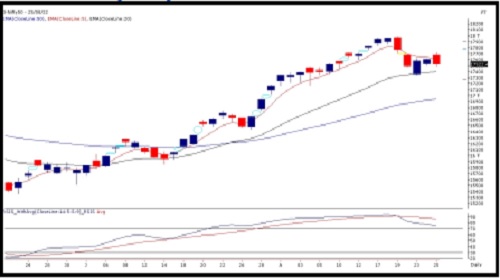

Sensex (58775) / Nifty (17522)

The August F&O expiry session started with a gap up opening however post opening there was no major traction in key indices. The real action was seen outside the index as many individual stocks witnessed mesmerizing moves and the undertone remained bullish. During the last hour, however, the expiry play started as after breaking intraday support levels there was a cascading effect that dragged Nifty towards 17500 and ended just above it with a loss of around half a percent.

The week so far has been completely action-packed as the benchmark index has seen wild swings on both sides of the trend. Yesterday as well the key indices seemed lackluster post a gap up opening however the last hour sell-off was quite imposing. The overall market breadth remained positive, and we sense the last hour's sell-off was an expiry session adjustment. It would be crucial to see how the markets react on the last day of this eventful week. We continue to see Tuesday’s low around 17350 a strong support zone and as long as Nifty holds the same there’s no need for bulls to worry for. On the flip side, 17700 – 17750 is seen as immediate resistance and for the bulls to strike momentum will have to close above it with some authority.

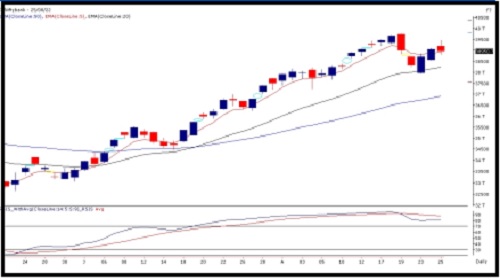

Nifty Bank Outlook (38951)

Bank Nifty as well started with a gap up opening and extended the gains during the midsession towards the 39500 levels however along with the broader markets it witnessed a profit booking during the last hour to not only erase morning gains but to end in a loss of 0.22% tad 38950.

The bank index has been an outperformer for the major part of the August series and yesterday as well it outshined during the first half of the expiry session. There was however some tentativeness when it reached the higher end of the bearish engulfing candle stick formation seen on Friday and eventually along with the broader markets it witnessed profit booking. As mentioned above, we sense the last-hour sell-off as an adjustment of the contract expiry and it would be crucial to see how markets react on the first day of the September contract. We continue to remain positive and expect buying to emerge at lower levels however one should avoid undue risk as the volatility in the global markets remains on the higher side. As far as levels are concerned, immediate support is placed around 38660 - 38500 levels whereas resistance is seen around 39200 - 39450 levels.

To Read Complete Report & Disclaimer Click Here

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One