Equity benchmarks started the monthly expiry week on a negative note tracking weak global cues - ICICI Direct

Technical Outlook

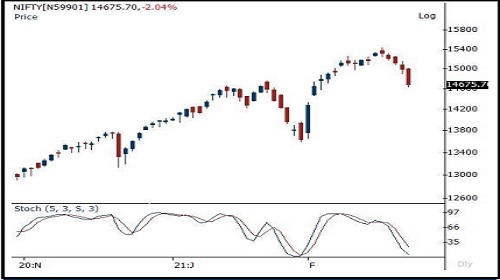

Equity benchmarks started the monthly expiry week on a negative note tracking weak global cues. The Nifty ended the session at 14676, down 306 points or 2%. In the coming session, we expect bias to remain corrective as long as index maintains lower high-low formation, as the intraday pullback remained short lived over past couple of sessions. Hence, use intraday pullback towards 14790-14817 to create short position for target of 14706.

Going ahead, we believe, extended correction from hereon would offer incremental buying opportunity as we do not expect index to breach the key support threshold of 14300. Therefore, any dip from here on should be capitalised to accumulate quality stocks in a staggered manner. Meanwhile 14900 would act as immediate resistance. Our constructive bias is based on following observations: Since May 2020, a) index has not sustained below its 50 days EMA b) Pricewise, index has not corrected for more than 8%- 9%. c) Time-wise, secondary correction has not lasted for more than a week

Nifty Daily Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Index is likely to open on a gap up note today and is likely to remain positive during the d...