No Record Found

Latest News

Commodity Research- Daily Evening Track - 13 -Feb-20...

Evening Roundup : Daily Evening Report on Bullion, B...

Radico Khaitan Strengthens Leadership Team to Drive ...

India's Palm Oil Imports Surge 51% in January by Ami...

India can cross 10 per cent GDP: Uniphore CEO ahead ...

India Exim Bank forecasts India`s merchandise export...

Buy Zaggle Prepaid Ocean Services Ltd for the Target...

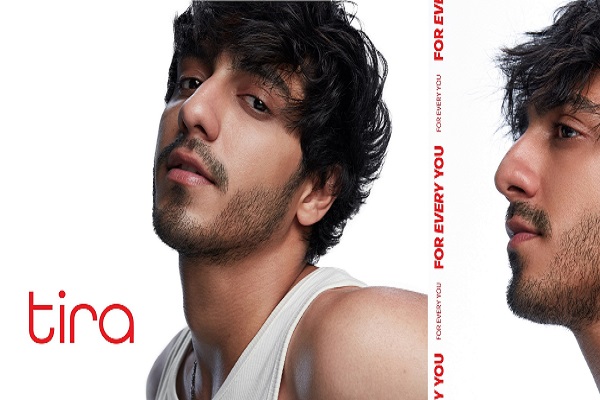

Tira Welcomes Ahaan Panday as Brand Ambassador, Stre...

Quote on Gold 13th February 2026 by Jateen Trivedi, ...

Quote on Nifty 13th February 2026 by Rupak De, Senio...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found