Auto Sector Update - Jun`21: PV/Tractor wholesales driven by demand pull By Motilal Oswal

Jun’21: PV/Tractor wholesales driven by demand pull

Weak retail commentary by 2Ws/CVs indicates build up in inventory

2Ws, CVs, and Tractors were above our muted expectations, while PVs were in line with our optimistic estimates. While Jun’21 was the first month post lifting of the lockdowns by states, demand remains skewed towards PVs and Tractors (higher than Jun’19), with CVs and 2Ws yet to catch up. 2W/M&HCV/LCV volumes fell by 10%/33%/19% CAGR (v/s Jun’19), whereas the same for PV/Tractors grew by 8%/20% CAGR. Based on weak feedback for 2W/M&HCV retails, there seems to be a further inventory build-up in 2Ws (45-60 days).

2Ws – Above our estimate, 10% CAGR decline (v/s Jun’19):

Volumes declined by 10% CAGR (v/s Jun’19, +13% YoY). Domestic 2W sales surprised, whereas exports were restricted due to logistic issues in Jun’21. Volumes for HMCL/RE/BJAUT/TVSL declined by 13%/14%/6%/8% CAGR over Jun’19 (grew 4%/13%/22%/25% YoY).

PVs – in line, grew by 8% CAGR (v/s Jun’19):

PV wholesales are driven by order backlog and a demand recovery, with a gradual opening of the market. MSIL’s volumes were in line (+9% CAGR v/s Jun’19, +157% YoY). MM’s volumes (UVs including Pickups) declined by 7% CAGR (v/s Jun’19, +65.5% YoY). TTMT’s PV volumes posted a growth of 34% CAGR (v/s Jun’19, +66% YoY).

CVs – Above our estimate, 25% CAGR decline (v/s Jun’19):

Both M&HCV and LCV volumes were above our estimates,signaling inventory building by OEMs (post supply-side issues in the last few months). M&HCV/LCV volumes posted a 33%/19% CAGR decline (v/s Jun’19), but grew 136.5%/107% YoY. AL posted a 29% CAGR decline (v/s Jun’19, +169% YoY). TTMT’s CV volumes declined by 24% CAGR (v/s Jun’19, +111% YoY). VECV posted a 27% CAGR decline (v/s Jun’19, +79.5% YoY).

Tractors – Above our estimate, 20% CAGR growth (v/s Jun’19):

Tractor volumes grew by 20% CAGR (v/s Jun’19, +28% YoY). With the timely arrival of monsoons and government support in the form of higher MSP prices, MM/ESC’s Tractor volumes posted a 21%/15.5% CAGR growth over Jun’19.

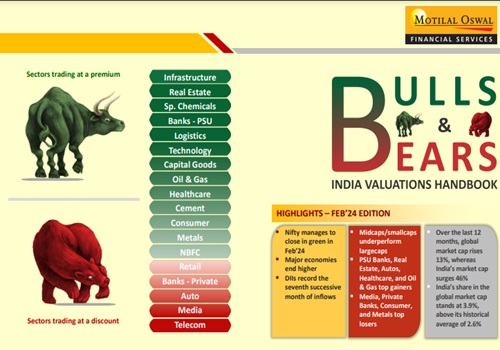

Valuation and view:

Jun’21 saw a gradual lifting of lockdown restrictions across states, with a good recovery witnessed in PVs and Tractors. Current valuations largely factor in a sustained recovery (our base case), leaving a limited margin of safety for any negative surprise. We prefer 4Ws over 2Ws, as PVs are the least impacted segment currently and offer a stable competitive environment. We expect the CV cycle to recover and gain momentum towards 2HFY22. We prefer companies with: a) a higher visibility in terms of a demand recovery, b) a strong competitive positioning, c) margin drivers, and d) Balance Sheet strength. MSIL and MM are our top OEM picks. Among Auto Component stocks, we prefer ENDU and BHFC. We prefer TTMT as a play on global PVs.

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

More News

Electronic Manufacturing Services : Still tariff-free, but not yet risk-free by JM Financial...