No Record Found

Latest News

Haryana CM Nayab Saini announces second instalment o...

Viral Video: CM Yogi Adityanath feeds peacock during...

Neutral Blue Star Ltd for the Target Rs. 1,950 by Mo...

Day-4 of the Winter Session 2025: Rajya Sabha MP Sud...

BJP MP Gulam Ali Khatana hopes Russia Prez Putin`s v...

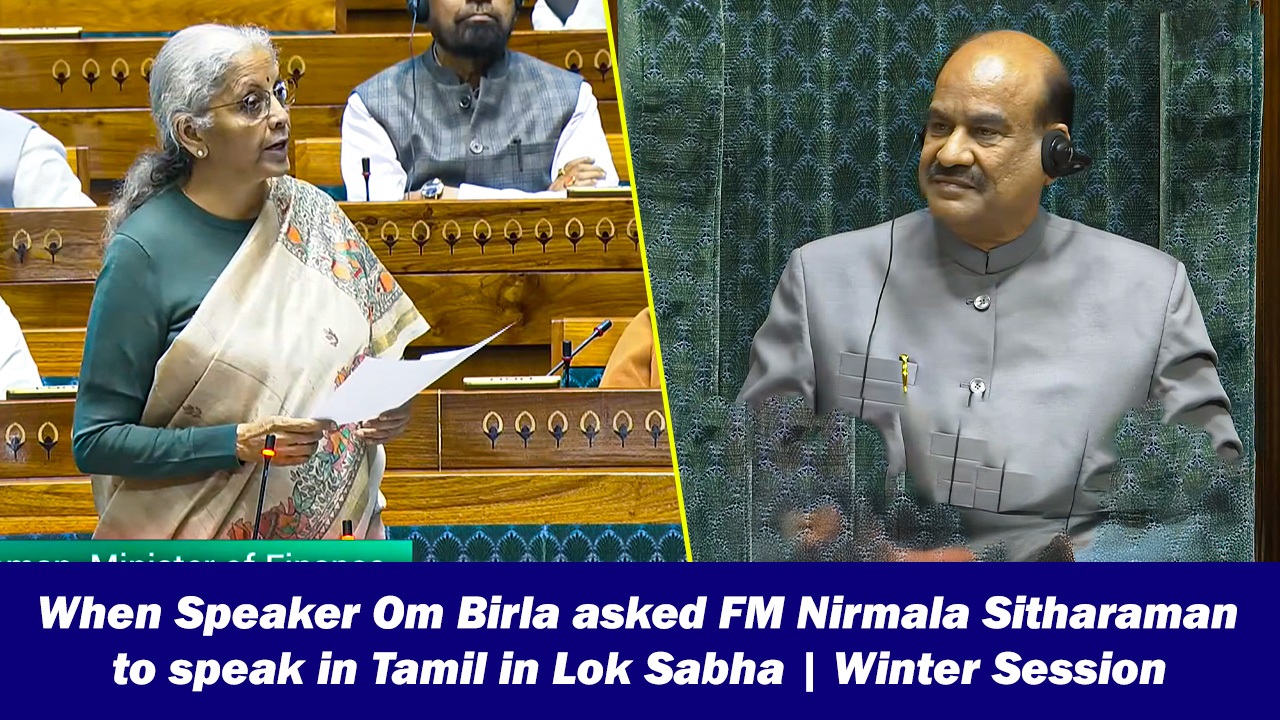

When Speaker Om Birla asked FM Nirmala Sitharaman to...

Quote on `the recent depreciation of INR against the...

Delhi: Russian First Deputy Prime Minister Denis Man...

Priyanka Chaturvedi welcomes withdrawal of Sanchar S...

Delhi shines with lights and flags as President Puti...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found