No Record Found

Latest News

Healthcare gets booster shot with Rs 10,000 crore fo...

BJP makes budget for country's 5 per cent, giving be...

Government to set up high-level committee on banking...

Centre proposes 7 high-speed rail corridors to link ...

Budget 2026-27 hikes Government capex to Rs 12.2 lak...

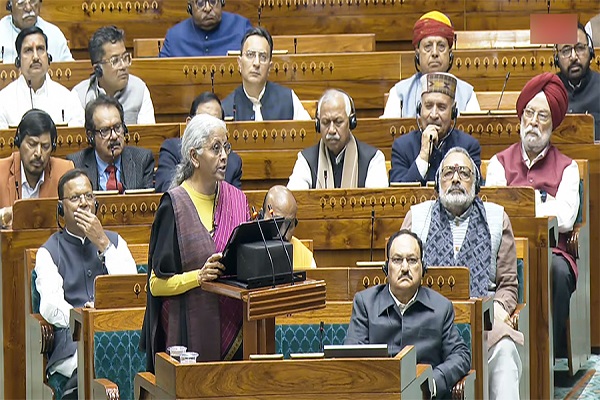

FM Nirmala Sitharaman?lists 3 ?Kartavyas? to acceler...

Budget 2026-27 hikes Govt capex to Rs 12.2 lakh cror...

India to ensure Aatmanirbharta, Budget driven by Yuv...

Govt hikes component manufacturing outlay to Rs 40,0...

Giant 6-ft artwork of Nirmala Sitharaman created by ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found