No Record Found

Latest News

Daily Derivatives Report 23nd January 2026 by Axis S...

From Davos to Delhi, next decade belongs to India: P...

India emerging as global power hub with huge growth ...

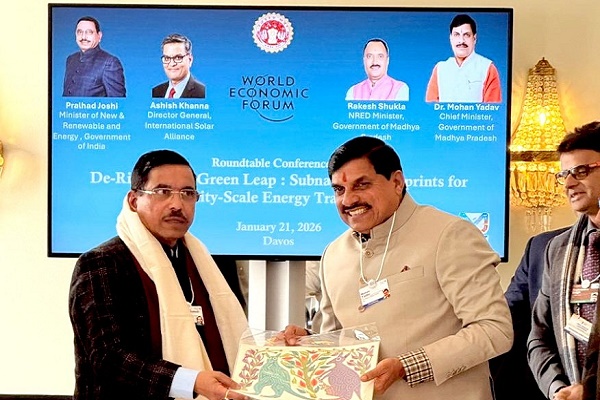

India to become 3rd largest economy soon: MP CM Moha...

Stock Picks : Tata Steel Ltd, REC Ltd - ICICI Direct

India shows strong macroeconomic stability, capital-...

Nifty bounced back sharply today and closed higher -...

MSDE joins World Economic Forum to boost India`s ski...

Nifty opened with an upward gap but witnessed sellin...

Adani Total Gas posts 11 pc jump in Q3 profit, reven...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found