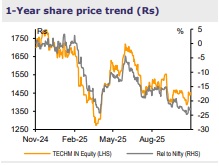

Reduce Tech Mahindra Ltd for the Target Rs.1,450 By Emkay Global Financial Services Ltd

Transformation in motion; FY27 goals intact

We attended the ‘Mahindra Group Investor Day’, and came back with a deeper understanding of TechM’s growth strategy and outlook. Mohit Joshi (CEO and MD - TechM) reiterated TechM’s FY27 aspirations: 1) Revenue growth above peer average (TCS, Infosys, Wipro, and HCLTech). 2) EBITM of 15%. 3) RoCE of ~30%. 4) Payout of >85% of FCF to shareholders. The company is on track to execute its 3-year roadmap and expects turnaround to be completed by FY27. It focuses on scaling up its high-growth service lines (Engineering, Cloud, Data and AI, and Consulting), deepening client relationships for expanding wallet share, investing in consulting and GenAI, and accelerating automation-led delivery for margin expansion. The management aspires to deliver profitable and sustainable growth, higher than the peer average. It expects revenue to grow ~1.3x over FY20-27 which implies ~3.7% CAGR over FY25-27, and is broadly in line with our expectations. We retain REDUCE on TechM and our TP of Rs1,450, at 18x Sep-27E EPS.

Halfway to FY27 goal; transformation in motion

TechM’s 3Y roadmap is unfolding in phases: i) Turnaround phase (FY25): concentrated on investments in priority markets, service lines, key accounts under Project Turbocharge to scale up large accounts, front-end integration of portfolio-companies, and Project Fortius. ii) Stabilization phase (FY26): to see completion of integration, sustenance of above-normal investments, and extension of cost and productivity benefits. iii) Reaping returns phase (from FY27): to see improved revenue mix, a refined delivery pyramid, and delivery of targeted financial outcomes.

Three-vector strategy stack

TechM’s strategy is built on three growth vectors: Growth, Operations, and Organization. 1) Growth sharpens focus on large accounts, priority geographies, and core verticals (BFSI, Retail, Logistics and Transport, and Healthcare), powered by specialist sales and the Turbocharge program. 2) Operations target structural margin lift via Project Fortius – optimizing the pyramid mix, offshore leverage, subcontractor use, utilization, pricing, and the service-line mix. 3) The Organization vector strengthens leadership (aligned and stable now) and integration across portfolio companies and the Mahindra Group.

AI delivery with strategy, scale, and speed

TechM’s ‘AI Delivered Right’ strategy has quickly gained momentum, driving robust dealwins and earning industry recognition across the four core pillars of productivity, transformation, innovation, and assurance. The company has built an AI continuum, beginning with the launch of its GenAI Studio in 2023, development of its own LLM in 2024, expansion of models across 38 Indian languages, and introduction of TechM Orion (is a comprehensive platform for agentic AI development) in 2025

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354