Zerodha Fund House Launches Zerodha Multi Asset Passive FoF

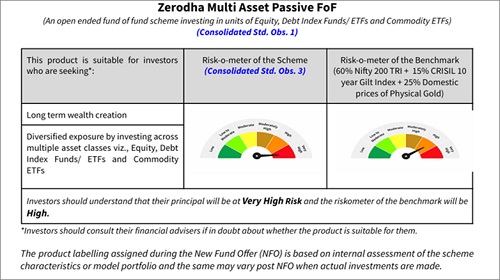

Zerodha Fund House today announced the launch of its new scheme ‘Zerodha Multi Asset Passive FoF’, an open ended fund of fund scheme investing in units of Equity, Debt Index Funds/ETFs and commodity ETFs. The New Fund Offer of the scheme is currently open for subscription.

This multi-asset fund is a 4-in-1 fund that invests across Equity LargeCap, Equity MidCap, Gold, and G-sec ETFs in a pre-defined allocation. This fund is a simple way for investors to begin their long-term investing journey, without juggle between the asset classes manually.

“The Zerodha Multi Asset Passive FOF is a good starting point for those investors seeking to diversify through a simple ready-made portfolio in a single investment” said Vishal Jain, CEO, Zerodha Fund House.

This fund aims to follow a balanced approach, taking exposure of close to 30% in Large Cap ETF - following top 100 index which consists of companies that are generally considered the market leaders of their respective sectors, 30% Mid Cap ETF - following mid 150 index which gives exposure to companies with relatively higher growth potential, 25% in Gold ETF - tracking gold which acts as a hedge against equity market uncertainty, 15% in G-sec ETF - investing in government securities with an aim to provide further stability to the portfolio.

This diversified fund maintains suitable exposure through periodic internal rebalancing. A key feature is that these adjustments do not trigger a taxable event, offering a significant advantage over an investor manually rebalancing a portfolio of individual assets. Tax liability is only incurred when an investor redeems the fund units.

“This new fund takes the guesswork out of investing, offering diversification and easy access to multiple asset classes. It’s designed to be a no-brainer solution for anyone looking for a simple way to achieve their asset allocation goals.” said Vaibhav Jalan, CBO, Zerodha Fund House.

The minimum amount for application is just Rs.100 and in multiples of 100 during the NFO, making it easy and accessible for investors.

Interested investors can apply for the NFO on all major mutual fund investing platforms. For more information on the schemes, please visit: https://www.zerodhafundhouse.com/

Above views are of the author and not of the website kindly read disclaimer

Tag News

Invesco Asset Management (India) announces change to OPA