Surge in Thematic Investments in 2024 Energy, Manufacturing, and Infra Leads Mutual Fund Industry Growth: Ventura Securities

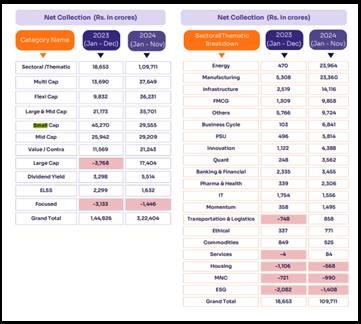

According to a report by Ventura Securities, "Mutual Fund Calendar Year Performance – 2024” Sectoral/thematic funds collected for Rs. 1,09,711 crores (34% of total net collections). Notably, thematic funds witnessed a remarkable 488% growth in net collections from 2023 to 2024.

Under sectorial and thematic schemes, Business Cycle Funds net collection stood at Rs. 6,841 crores in 2024 from Rs. 103 crores in 2023. While, Energy sector collected Rs. 23,964 in 2024 crores as compared to Rs. 470 crores in 2023.

Of the total net collection in sectoral and thematic funds in 2024, Manufacturing, Infrastructure, & Energy together contributed 56%, followed by 9% by FMCG, 6% in Business Cycle and 5% in PSU.

The Net Collections under Large caps stood at Rs. 17,404 crores in 2024 compared to Rs. -3,768 crores in 2023. Net Collections under Multi caps & Flexicap stood at Rs. 37,649 crores & Rs. 36,231 crores, respectively in CY 2024.

The Net Collections under small caps dipped to Rs. 29,555 crores in 2024 compared to Rs. 45,270 crores in 2023.

Foreign investment flow

In 2024, FIIs registered a net equity outflow of Rs.3.04 lakh crores, with September showing the highest inflow and October the highest outflow of Rs.1.14 lakh crores. There were only 4 months of inflows, compared to 6 in 2023, resulting in net FII outflows in both years.

Domestic Investment Flow

DIIs recorded a net equity inflow of Rs.5.27 lakh crores, with October 2024 seeing the highest inflow of Rs.1.07 lakh crores. DII net equity inflows nearly tripled compared to 2023. Despite FIIs' high outflow in October, DIIs helped balance the situation with their record equity inflow for the month.

Indices performance

Private sector banks underperformed in 2023 and 2024, delivering just a 0.4% return in 2024. Energy saw a huge drop from 30.6% in 2023 to 6.5% in 2024, while FMCG declined sharply from 30.8% in 2023 to 1.5% in 2024. Defense led as the top-performing index in 2024 with a 56.5% gain and remained in the top 5 since 2023. Small cap also consistently ranked in the top 5 for both years, with none of the indices ending in negative territory for the second consecutive year.

Category Average Performance

All categories achieved double-digit, positive returns for the second consecutive year. In 2023, PSU led with the highest return of 56.1%, while Banking & Financials recorded the lowest at 20.7%. In 2024, Pharma topped the list with a 40.5% return, whereas Banking & Financial Services had the lowest at 11.5%. Over a 5-year average, Technology and Small Cap funds outperformed, while Banking and Large Cap funds lagged. ELSS funds also averaged an impressive 20% annual return

over 5 years, making them a strong option for tax-saving investments. The average returns, which stood at 32.3% in 2023, have moderated to 22.6% in 2024.

Top & Bottom performing Schemes of 2024

There is a significant performance gap between the top and bottom funds in most frontline categories, except Large cap. Bottom funds have outperformed benchmarks in Large and Midcap. One-year performance should not be the sole criterion for judging scheme performance. Investors should assess 3-year performance due to frequent rotations among winners.

Category-wise Schemes that have outperformed their Benchmark

Broad categories have outperformed in comparison to 2023, with the primary outperformance seen in sectoral and thematic funds. Small caps have underperformed relative to large and mid-caps, this trend is reflected in the category's performance.

AMC Schemes that have outperformed the Benchmark

Larger AMCs are underperforming their benchmarks, possibly due to managing larger corpus and a higher number of schemes. In contrast, smaller AMCs have shown a better track record. ICICI and Aditya Birla have the highest number of schemes in their portfolio.

The investment field in 2024 reflected an evolving market sentiment, marked by a rise in thematic investments, contrasting FII and DII flows, and remarkable sectoral shifts. While challenges persisted in certain sectors, key areas like defense and Thematic Funds highlighted strong investor confidence and potential avenues for growth. As markets adapt to these shifts, they pave the way for strategic opportunities in 2025.

Above views are of the author and not of the website kindly read disclaimer

.jpg)