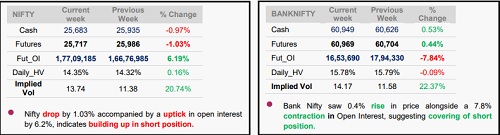

Weekly Option strategy on Nifty 17th February 2026 by Axis Securities

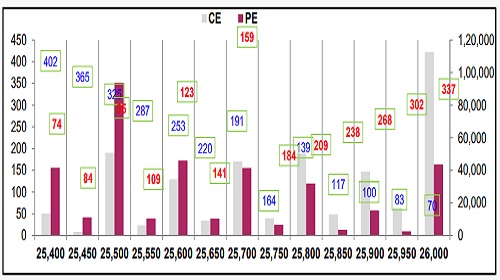

Current Week Expiry Nifty Open Interest Distribution

* The highest Open Interest on the Call side is at the 26,000 strike, followed by 25,500 which could act as resistance levels.

* On the Put side, the highest Open Interest is at 25,500 followed by 25,400 which may serve as support levels.

* The premium for the At-the-Money option is Rs. 355, indicating a likely trading range for the week between 25,400 and 26,200

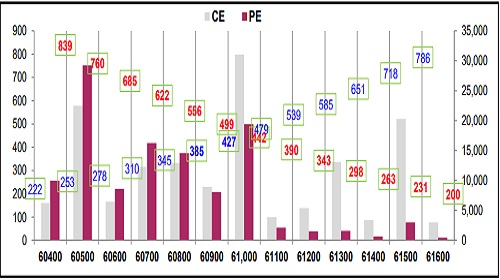

Monthly Expiry Bank Nifty Open Interest Distribution

* The highest Open Interest on the Call side is observed at the 61,000 strike, followed by 60,500 which may act as resistance levels.

* On the Put side, the Highest Open Interest is at 60,500, followed by 61,000 which might act as support levels.

* The premium for the At-the-Money option stands at Rs. 873, indicating a probable weekly trading range between 59,800 and 62,200

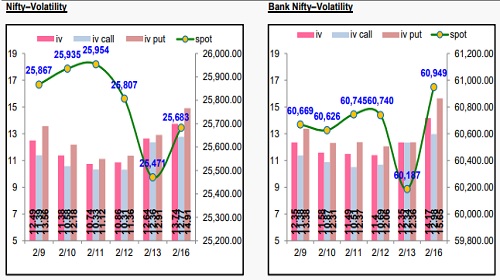

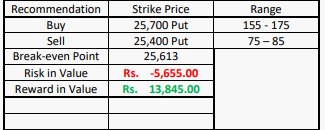

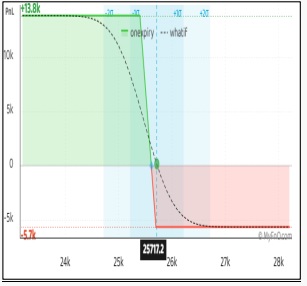

NIFTY Strategy: - Bear Put Spread.

* View: - Moderately Bearish.

* Rationale: - Traders may consider deploying this spread strategy to achieve moderate returns while maintaining controlled risk and reward. The strategy involves buying one lot of the 25,700 strike Put Option and simultaneously selling one lot of the 25,400 strike Put Option.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Tag News

Quote on Markets 12th March 2026 by Mr. Vikram Kasat, Head Advisory, PL Capital