Weekly Derivatives Insights 29th September 2025 by Axis Securities

The Week That Was:

* Nifty futures closed at 24,689.9 on Friday, declining 2.8% (721.3 points) alongside a 25.9% rise in open interest, indicating long unwinding activity.

* Bank Nifty futures closed at 54,474.8, posting a 2.1% decline (1,179.6 points) accompanied by a 22.4% rise in open interest, reflecting long unwinding.

* India VIX rose 14.6%, climbing from 9.97% to 11.43%, indicating a notable uptick in market volatility expectations.

* The FII Long-Short ratio increased from 0.15 to 0.17, additions in both long and short positions, with shorts outpacing longs, signaling weak market sentiment.

* Total outstanding open interest (OI) in Nifty futures rose to 202.99 lakh contracts from 177.92 lakh the previous week, while Bank Nifty futures increased to 27.84 lakh from 23.98 lakh, indicating a buildup in positions across both indices.

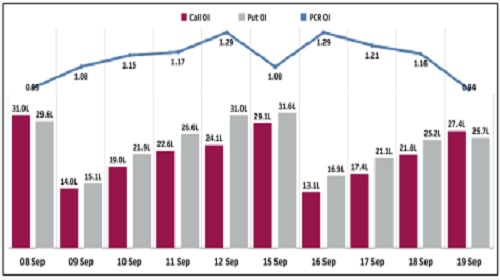

* Nifty’s PCR fell by 0.31 over the week, closing at its lowest level, driven by a sharp decline in put option open interest relative to calls signaling a cautious undertone and suggesting aggressive call writing.

Nifty Open Interest Put-Call Ratio

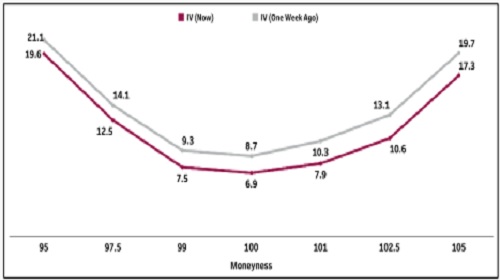

Volatility Analysis

* The implied volatility (IV) curve for the upcoming weekly expiry signals a market consensus for lower realized volatility. The decline, notable in both out-of-the-money calls and puts, points to lower expectations for actual market swings.

* A flattening term structure corroborates this view, indicating reduced demand for both speculative and hedging strategies ,reinforcing expectations for a range-bound market in the week to come.

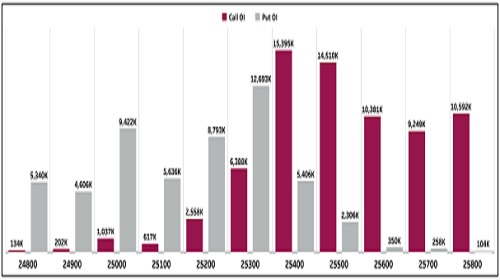

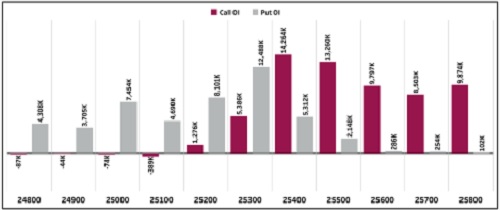

Nifty Open Interest Concentration (Weekly)

* The strike-concentration for the upcoming expiry on September 30 shows that the Nifty has strong supports at 24,500 and 24,000, while resistance can be seen near 25,000 and 24,800.

* Speaking of open interest changes, the 25000-strike Call and 24500 strike Put saw the maximum addition, alongside the 25100 strike Call and 24600 strike Put.

* Based on the data, we project the Nifty to trade between 24,500 and 25,000 in the week ahead.

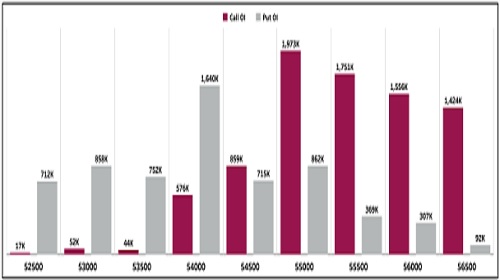

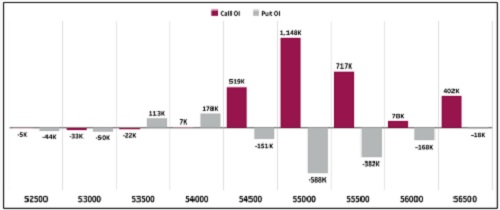

Bank Nifty Open Interest Concentration (Monthly)

* The strike concentration for the September expiration shows that the Bank Nifty has strong supports at 54,000, 53,000, and 53,500, while resistance rests at 56,000, 55,000, and 55,500.

* Speaking of open interest changes, the 55000-strike Call and 54400 strike Put saw the maximum addition, alongside the 55300 strike Call and 54300 strike Put.

* Based on the data, we project the Bank Nifty to trade between 53,500 and 55,000 in the coming week.

Nifty Change in Open Interest (Weekly)

* Using the monthly expiration cycle, notable addition in calls was seen at the following strikes - 25,000 (146.8 Lc), 25,100 (137.2 Lc), and 24,800 (116.6 Lc), respectively. There was unwinding observed at 25,000 & 25,100 strike.

* Coming to puts, the 24,500 (79 Lc), 24,600 (72.5 Lc), and 24,200 strikes (49.6 Lc) saw considerable addition in open interest. Unwinding was witnessed at the 25,400 & 25,300 strike

Bank Nifty Change in Open Interest (Monthly)

* For the Bank Nifty - based again on the monthly expiration cycle - notable addition in calls was seen at the following strikes - 55,000 (11.5 Lc), 55,300 (7.9 Lc), and 55,200 (7.2 Lc), respectively. There was marginal unwinding observed at 53,000 and 55,800 strikes.

* Coming to puts, the 54,400 (5.3 Lc), 54,300 (4.5 Lc), and 54,200 strikes (3.4 Lc) saw considerable addition in open interest. There was unwinding observed at 55,000 and 55,500 strike.

Weekly Participant-wise Open Interest (contracts)

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Quote on Market Wrap 13th Feb 2026 from Mr. Ajit Mishra ? SVP, Research, Religare Broking Ltd