Weekly Derivatives Insights 19th January 2026 - Axis Securities

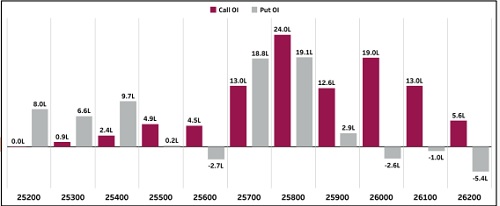

Nifty Open Interest Concentration (Monthly)

The Week That Was:

• Nifty futures closed at 25,751.5, down 36.8 points (0.1%) with open interest easing 0.18 lakh to 189.39 lakh, indicating long unwinding and reflecting cautious sentiment.

• Bank Nifty futures settled at 60,194.4, rising 653 points (1.1%) with open interest up 6.4% to 14.70 lakh after an addition of 0.87 lakh contracts, signaling long build-up and reflecting strong bullish sentiment.

• India VIX rose 4.0%, climbing from 10.93% to 11.37%, signaling a mild uptick in volatility expectations and suggesting a cautious undertone in market sentiments.

• FII Long-Short ratio rose to 0.10 from 0.08, as heavy short additions outpaced long positions nearly twofold, underscoring aggressive bearish sentiment and strong downside conviction among institutional traders.

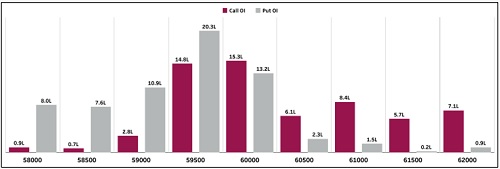

Bank Nifty Open Interest Concentration (Monthly)

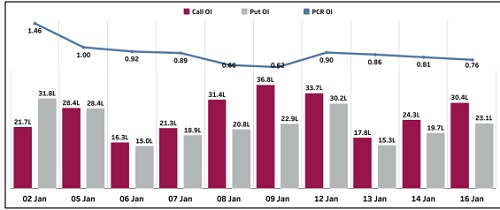

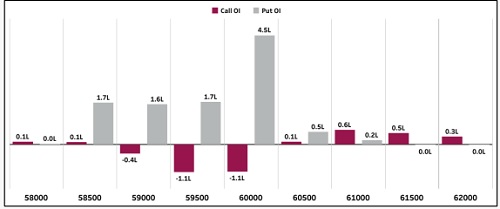

Nifty Open Interest Put-Call Ratio

• Nifty Put-Call Ratio (PCR) rose 0.14 over the week as call OI declined and put OI increased, with puts outpacing calls indicating a tilt toward cautious, bearish sentiment.

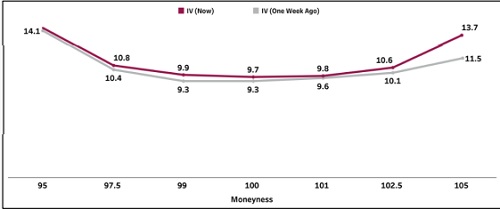

• The week-over-week spike in implied volatility across out-of-the-money strikes suggests that the market is pricing in a significant expansion of realized volatility.

• The volatility term structure is steepening and widening, signaling a heightened sensitivity to tail risk. This shift has triggered a surge in demand for downside protection and a broad de-risking of leveraged positions as participants brace for a more volatile environment.

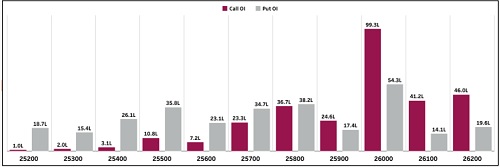

• For the current monthly expiry, Nifty resistance has tightened as Call concentration shifted lower from 27,000 to 26,500, signaling a descending ceiling. Meanwhile, the support floor remains robust at 26,000 and 25,000. This compression indicates a narrowing trading range with a growing bearish bias on upside recovery.

• Speaking of open interest changes, the 26,500-strike Call and 25,800 strike Put saw the maximum addition.

• Based on the data, we project the Nifty futures to trade between 25,500 and 26,000 in the week ahead.

• For the current monthly expiry, Bank Nifty support has strengthened as Put concentration climbed from 59,000 to 60,000, mirroring the Call resistance at the same level. This massive build-up at 60,000 on both sides indicates a major psychological tug-of-war and a potential breakout or pin risk near this strike

• Speaking of open interest changes, the 60,100-strike Call and 60,000 strike Put saw the maximum addition, alongside the 60,700 strike Call and 59,800 strike Put.

• Based on the data, we project the Bank Nifty to trade between 59,500 and 61,000 in the coming week.

• For Nifty in the current monthly expiration cycle, notable addition in calls was seen at the following strikes - 25,700 (13.1 Lc), 25,800 (24 Lc), and 26,000 (19 Lc), respectively. There was no significant unwinding observed at any strike.

• Coming to puts, the 25,800 (19.1 Lc), 25,700 (18.8 Lc), and 25,400 strikes (9.7 Lc) saw considerable addition in open interest. There was notable Unwinding witnessed at 26,300 & 26,200 strike.

• For the Bank Nifty based on the current monthly expiration cycle - notable addition in calls was seen at the following strikes - 60,100 (1.8 Lc), 60,700 (1.6 Lc), and 61,000 (0.6 Lc), respectively. There was unwinding observed at 59,500 & 60,000 strike.

• Coming to puts, the 60,100 (2.1 Lc), 60,000 (4.5 Lc), and 59,800 strikes (2.2 Lc) saw considerable addition in open interest. There was no significant unwinding observed at any strike.

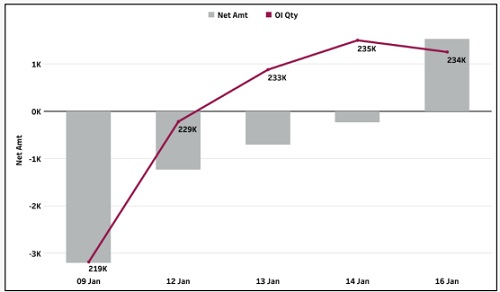

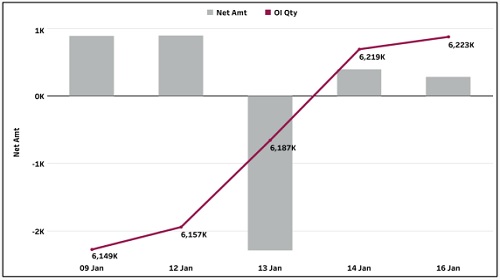

• FII's total open interest in Index Futures is at Rs 39,405 ,which on weekly basis has increased by Rs 2,524 Crs.

• Foreigners had 2,34,003 Index futures contracts open, adding 14,940 contracts from the previous week, with Nifty futures witnessed added 11544 contracts and Bank Nifty futures added 2065 contracts.

• In Nifty options, they finished the week with 23,53,224 contracts which has reduced by 2,57,564 contracts and in Bank Nifty it has added 39,039 contracts and ended the week with 2,40,740 contracts.

• FIIs are demonstrating a cautiously bullish outlook by aggressively expanding long futures positions while simultaneously streamlining their options exposure.

• Coming to Stock Futures, open interest was at Rs 4,20,361 which on weekly basis have increased by Rs 6,225 Crs.

• The total number of Stock Futures contracts stood at 62,23,393 adding 74,411 contracts over the previous week.

• For Stock Options, open interest was at 7,82,851 contracts, adding 2,28,698 contracts on the week.

• FIIs are exhibiting an aggressively optimistic stance by significantly expanding their individual stock holdings while utilizing a massive surge in options for tactical leverage.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633