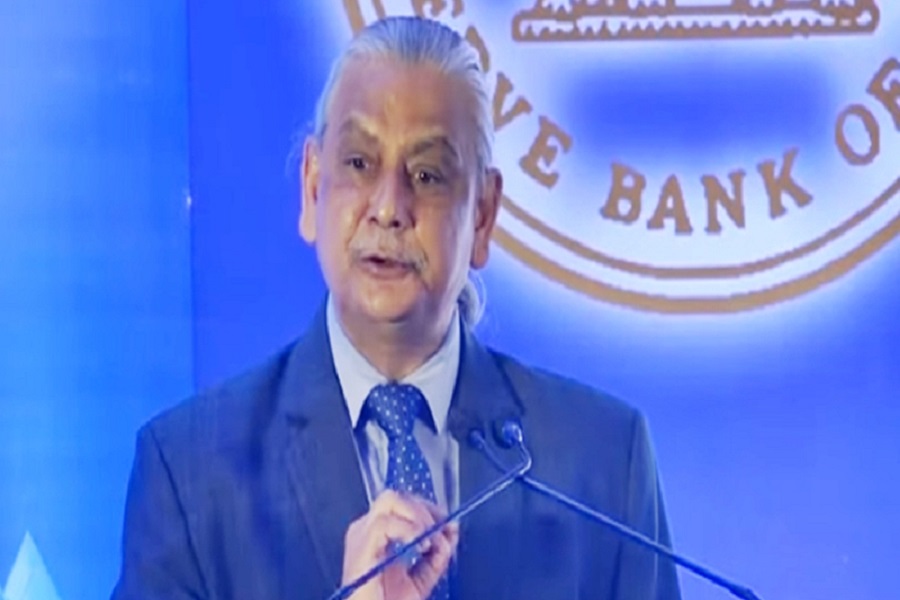

Quote on Market Wrap Up by Shrikant Chouhan, Head Equity Research, Kotak Securities Ltd

Below the Quote on Market Wrap Up by Shrikant Chouhan, Head Equity Research, Kotak Securities Ltd

Today, the benchmark indices corrected sharply, with the Nifty ends 354 points lower while the Sensex was down by 1390 points. Among the sectors, the Realty Index was the top losers, shed over 3 percent. Meanwhile, despite weak market sentiment, the Media Index gained 2 percent.

Technically, after a weak open, the market bounced back sharply; however, due to consistent selling pressure at higher levels, it again corrected sharply again. A long bearish candle on daily charts, combined with a correction continuation formation on intraday charts, indicates further weakness from the current levels.

For day traders, 23,100/75800 would be the key support zone. If the market manages to trade above this level, we could expect a pullback rally to 23,300-23,350/76500-76650. On the flip side, a dismissal of 23,100/75800 could accelerate the selling pressure. If this level is breached, the Nifty could retest the levels of 50 day SMA (Simple Moving Average) or 23,000-22,950. For Sensex 75500-75300, Given the current market texture is volatile, level-based trading would be the ideal strategy for day traders

Above views are of the author and not of the website kindly read disclaimer