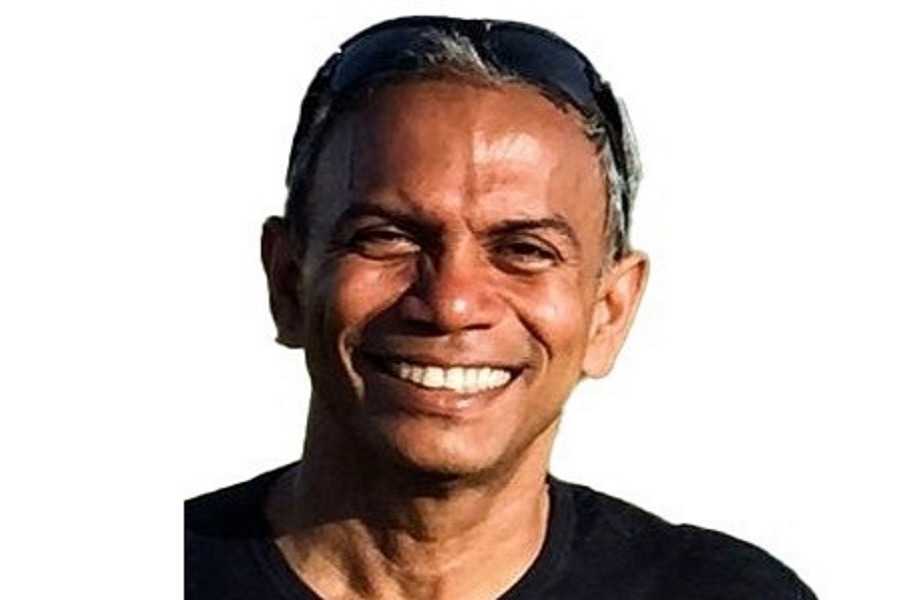

Views on T+0 settlement cycle innovative leap by SEBI - Vamsi Krishna, CEO, StoxBox

Below the Views on T+0 settlement cycle innovative leap by SEBI - Vamsi Krishna, CEO, StoxBox

Introducing the T+0 settlement cycle in the Indian capital markets is an innovative leap by the market regulator SEBI. This new move, starting with a beta version for a select 25 scrips, signifies a monumental shift from the traditional T+2 settlement cycle, promising same-day trade settlement. The transition towards T+0 not only enhances the efficiency and flexibility of market operations but also stands to substantially mitigate transactional risks, offering an immediate and tangible value to both traders and investors alike. Launching on March 28, 2024, for a limited trading window, this initiative marks a critical step in aligning India's trading infrastructure with global standards, paving the way for a stronger, risk-averse, and dynamic market ecosystem. As we look forward to the phased implementation across all scrips, leveraging these advancements, ensuring our clients benefit from the increased operational efficiency and the opportunity for quicker liquidity.

Above views are of the author and not of the website kindly read disclaimer