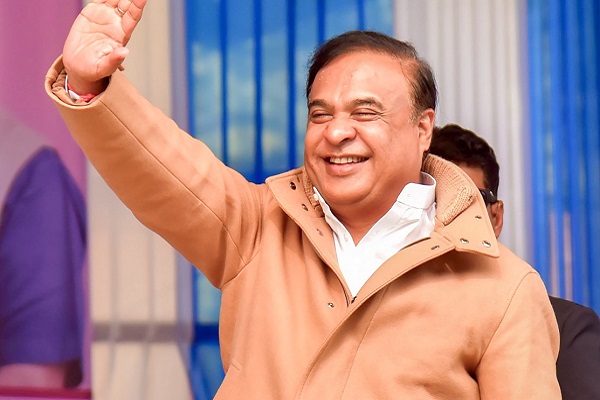

Views on RBI Monetary Policy by Mr. George Alexander Muthoot, MD, Muthoot Finance

Below the Views on RBI Monetary Policy by Mr. George Alexander Muthoot, MD, Muthoot Finance

We commend the RBI’s commitment to maintaining stability in India’s financial system by keeping the repo rate unchanged at 6.5% and its stance on ‘withdrawal of accommodation’. This prudent approach is crucial, particularly given the uneven expansion owing to geopolitical tensions in the Middle East. Despite these challenges, we are glad to witness stability in domestic economic activity on the back of the steady progress in south-west monsoons.

We take pride in RBI’s appreciation of the Indian financial system as it has been able to maintain resilience and showcase broader macroeconomic stability. At the same time, we also diligently acknowledge the key areas of concern highlighted by the honorable RBI Governor today including the need to closely monitor alternate investment avenues, be vigilant on personal loans, adhere to loan to value (LTV) ratio, risk weights and monitoring of end use of funds, and unprecedented global IT outage.

As India’s largest gold loan NBFC, we recognize the importance of enhancing sturdiness amidst global disruptions. The RBI’s call for banks and NBFCs to strengthen their risk management frameworks aligns well with Muthoot Finance’s proactive measures to maintain operational resilience and service continuity even during unprecedented and widespread outages. Additionally, the proposed public repository for digital lending apps is a significant move towards enhancing oversight and protecting customer interest. At Muthoot Finance, we take serious measures to bolster our digital platforms, focusing on cybersecurity and fraud detection to provide a secure financial environment and protect our customers’ confidence in our digital app. With digitalization transforming the financial sector rapidly, we are also committed to strategically upskill and reskill our workforce in line with the RBI’s guidance to navigate digital complexities effectively.

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on GST 2.0 Reforms by Anand Kumar Bajaj, Founder, MD & CEO, PayNearby