Union Mutual Fund Launches Union Consumption Fund aiming to Ride India`s Growing Consumption Cycle

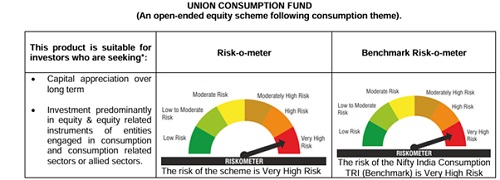

Union Mutual Fund announces the launch of its latest offering - the Union Consumption Fund, an open-ended equity scheme following consumption theme. The New Fund Offer (NFO) opens on December 1, 2025, and closes on December 15, 2025.

The launch comes at a time when India’s economy stands at a crucial inflection point. A combination of 5 big bang initiatives unveiled over the last one year by the Government–

* Lowered tax rate in FY 26,

* GST 2.0 revisions,

* Eighth Pay commission,

* Sustained lower Inflation and

* RBIs synchronised interventions coupled with good monsoons are guiding factors which could lead to an orbital shift in Consumption.

Consumption index has outperformed the broader market 13 times over the last 19 years. Between 2019 and 2024, the Nifty India Consumption TRI delivered an average return on equity of 14.7%, higher than the 12.5% average of the broader Nifty 500 Index. (Source: Bloomberg)

Speaking about the fund, Mr. Madhu Nair, CEO of Union Asset Management Company Private Limited (Union AMC), said: “On the back of 5 big structural changes unveiled by the GOI, India seems to on the cusp of a big shift in broad based Consumption. We believe our R.I.S.E. framework is suited to extract the most potential of this consumption theme. The expansion of the consuming class, the shift from mass to premium, and the digitization of marketplaces together could form one of the most powerful multi-decadal investment themes. Through the Union Consumption Fund, we aim to offer investors a disciplined and diversified way to participate in this journey where every rupee spent contributes to the story of progress.”

Union Consumption Fund (UCF) aims to invest in a universe that spans over sub sectors of consumption through its RISE framework which stands for - Reach, Intermediates, Spend Up & Experience, aiming to capture how India lives, spends and aspires.

R - Reach (Penetration): Companies expanding access to goods and services – such as consumer durables, packaged foods and quick-service restaurants.

I - Intermediates (Enablers): Businesses facilitating consumption – including digital platforms, fintech players and financial intermediaries.

S - Spend Up (Premiumization): Firms catering to aspirational and higher-value segments like the SUV market and real estate.

E - Experience (Consumer Services): Sectors where spending is driven by lifestyle and experiences – such as travel, hospitality and entertainment.

India’s per-capita income has nearly tripled since 2008 and is expected to grow another 1.6 times by FY2030, according to IMF World Economic Outlook Data estimates. The number of upper-middle and high-income households along with Middle income households are projected to expand from 11.3 crore in 2023 to 18 crore by 2030, marking a 60% increase in the country’s most consumption-heavy segment.

The Union Consumption Fund is ideal for investors seeking to align their portfolios with the structural transformation underway in India’s economy. The scheme aims to provide diversified exposure across multiple consumption touchpoints — from mass markets to aspirational categories — offering potential participation in both stable and high-growth opportunities.

The scheme will be managed by Mr. Vinod Malviya, Fund Manager – Equity and Mr. Sanjay Bembalkar, Head - Equity at Union AMC.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...