Turmeric Trading Range For The Day is 12454-13330 - Kedia Advisory

Gold

Gold prices rose by 0.93%, settling at 62362, driven by investor optimism regarding a potential rate cut by the Federal Reserve in March. This optimism persists despite a robust increase in headline inflation and stable core Consumer Price Index (CPI) data for December. The annual core inflation rate slightly decelerated to 3.9%, while the headline CPI surged to 3.4%, primarily due to elevated rentals and healthcare costs. Investors, as indicated by the CME FedWatch tool, are leaning towards a 25 basis points interest rate cut in March, with a probability exceeding 66%. This sentiment prevails despite the continued health of the U.S. labor market, emphasizing a willingness to prioritize economic stimulus over inflation concerns. Physical gold demand in major Asian hubs strengthened, particularly in anticipation of the approaching Chinese New Year, boosting buying interest in China and Singapore. Dealers in India offered discounts of up to $13 per ounce over official domestic prices, reflecting a notable increase from the previous week's $11 discount. In China, premiums rose to $45-$51 per ounce over spot prices, up from $37-$45 premiums the previous week. From a technical standpoint, the gold market is undergoing short covering, marked by a 0.43% drop in open interest to settle at 9260. Despite the decrease in open interest, gold prices increased by 574 rupees. The support level is identified at 61960, and a breach below could lead to a test of 61560 levels. On the upside, resistance is anticipated at 62725, and a move above this level might propel prices to test 6309

Trading Ideas:

* Gold trading range for the day is 61560-63090.

* Gold price climbs as investors are optimistic about Fed rate cuts.

* Investors ignore United States’ high consumer inflation data while US PPI remains soft.

* Fed policymakers reiterate a restrictive monetary policy stance to achieve price stability.

Silver

Silver prices surged by 1.58%, settling at 72480, driven by escalating Middle East tensions, which bolstered the appeal of the precious metal as a safe-haven asset. Despite stronger-than-expected U.S. inflation data, which typically strengthens the dollar and Treasury yields, silver benefited from geopolitical uncertainties. The United States and Britain initiated strikes against Houthi movement-linked sites in Yemen, prompting concerns over regional stability. The Federal Reserve is widely expected to maintain interest rates between 5.25% and 5.50%, but the outlook for March remains slightly hawkish. Fed policymakers, including Raphael Bostic and John Williams, along with Cleveland Fed President Loretta Mester, indicated that an interest rate cut in March is unlikely. Mester emphasized the need for more evidence of a sustained decline in inflation towards the 2% target. She highlighted the importance of maintaining a restrictive monetary policy, suggesting that further easing is contingent on improvements in various economic indicators, including goods prices, housing, and wage growth. From a technical perspective, the silver market is undergoing short covering, evidenced by a 30.81% drop in open interest to settle at 21653. Despite the decline in open interest, silver prices surged by 1126 rupees. The support level is identified at 71715, and a breach below could lead to a test of 70950 levels. On the upside, resistance is anticipated at 73245, and a move above this level might propel prices to test 74010.

Trading Ideas:

* Silver trading range for the day is 70950-74010.

* Silver gained as fears of escalating conflict in Middle East lifted the safe-haven appeal

* The United States and Britain launched strikes against sites linked to the Houthi movement in Yemen.

* The US PPI report showed a 0.1% decline in December, falling short of market expectations.

Crude oil

Crude oil prices experienced a 0.45% increase, settling at 6033 amid concerns over the escalating conflict in the Red Sea region, posing a threat to global trade. The United States and Britain launched airstrikes against Houthi military targets in Yemen in response to the group's attacks on Red Sea ships, expanding the regional conflict beyond the Israel-Hamas war in Gaza. China's crude oil imports in 2023 reached a record high, with customs data revealing a 11% increase compared to 2022, totaling 563.99 million metric tons or 11.28 million barrels per day. Despite economic challenges, this surge in imports reflects a recovery in fuel demand from the pandemic-induced slump. In contrast, U.S. crude oil stockpiles unexpectedly rose last week, with a 1.3 million barrel increase to 432.4 million barrels, contrary to expectations for a 700,000-barrel drop. Fuel inventories, particularly gasoline, also grew more than anticipated, reaching the highest level since February 2022 at 245 million barrels. Technically, the market is undergoing short covering, evidenced by a 20.55% drop in open interest to settle at 9245. Despite the decrease in open interest, crude oil prices rose by 27 rupees. The support level is identified at 5948, and a breach below could lead to a test of 5863 levels. On the upside, resistance is anticipated at 6177, and a move above this level might propel prices to test 6321.

Trading Ideas:

* Crudeoil trading range for the day is 5863-6321.

* Crude oil prices surged due to escalating conflict in the Red Sea region

* The US and Britain launched strikes against Houthi military targets in Yemen

* China's 2023 crude oil imports hit record as fuel demand recovers

Natural gas

Natural gas prices surged by 3.2%, settling at 274, driven by a larger-than-expected storage withdrawal in the U.S. last week. The U.S. Energy Information Administration (EIA) reported a withdrawal of 140 billion cubic feet (bcf) from storage during the week ended January 5, contributing to bullish sentiment in the market. Additionally, forecasts of extreme cold in the coming days raised expectations of record-high gas demand. China's natural gas imports, including both liquefied natural gas (LNG) and piped gas, recorded a 9.9% increase, reaching 119.97 million tons in 2023. While this figure is the second-highest on record after 2021, it underscores China's growing reliance on natural gas imports to meet its energy needs. In the U.S., average gas output in the Lower 48 states fell to 107.1 billion cubic feet per day (bcfd) in January, down from a monthly record of 108.5 bcfd in December. The recent output losses were relatively modest compared to significant drops during extreme weather events in previous years. Meteorologists anticipate a shift in U.S. weather patterns, transitioning from mostly warmer than normal conditions to colder than normal from January 13-21, before returning to mostly warmer than normal conditions from January 22-26. Technically, the natural gas market is experiencing fresh buying momentum, with open interest rising by 10.96% to settle at 19142. The support for natural gas is at 261.4, and a breach below could lead to a test of 248.7 levels. On the upside, resistance is likely at 282.9, and a move above could see prices testing 291.7.

Trading Ideas:

* Naturalgas trading range for the day is 248.7-291.7.

* Natural gas rose due to a larger-than-expected storage withdrawal and forecasts of extreme cold weather.

* US EIA reported a withdrawal of 140 billion cubic feet of gas from storage.

* Gas output in the Lower 48 states decreased in January, with daily output expected to reach a 10-week low.

Copper prices

Copper prices experienced a decline of -0.64%, settling at 712.4, influenced by a notable increase of 30.0% in copper inventories in Shanghai Futures Exchange-monitored warehouses since the previous Friday. China's copper imports also contributed to the downward pressure, registering a decline of 6.3% in 2023, as domestic production increased and a stronger U.S. dollar raised import costs. The easing of strict COVID-19 measures in China throughout 2023 allowed local copper producers to boost output and bring new projects online. In the first 11 months of the year, China produced 11.81 million tons of refined copper, marking a significant increase of 13.3% compared to the same period in 2022. Meanwhile, China's imports of copper ore and concentrate in 2023 reached a record high of 27.54 million tons, representing a 9.1% increase from the previous year. However, December saw a decline in China's copper imports, totaling 459,338 tons, down by 16.6% from November when imports reached the highest level in almost two years. The intense competition for mined copper supplies is expected to heighten, putting pressure on Chinese firms, mainly state-owned, which produce half of the world's refined copper. Technically, the copper market is under fresh selling, indicated by a gain in open interest by 8.58% to settle at 6480. Prices are finding support at 709.2, and a breach below may lead to a test of 706 levels. On the upside, resistance is likely at 717.9, with a move above potentially pushing prices to test 723.4.

Trading Ideas:

* Copper trading range for the day is 706-723.4.

* Copper dropped as inventories in SHFE warehouses rose by 30% from last Friday

* China's copper imports declined by 6.3% in 2023 due to increased domestic production

* The relaxation of COVID-19 measures in China allowed local copper producers to increase output and start new projects.

Zinc

Zinc prices experienced a marginal decline of -0.13%, settling at 223.05, as investors assessed the industrial outlook in the wake of US data influencing expectations of potential monetary easing by the Federal Reserve. The rise in zinc inventories in Shanghai Futures Exchange-monitored warehouses by 15.2% from the previous week added pressure on the market. The dollar index's slight decline occurred as investors weighed higher-than-expected US consumer price inflation against market expectations of a potential rate cut by the Federal Reserve as early as March. In China, a persistent slide in factory-gate prices signaled ongoing deflationary pressures, posing challenges to a robust economic recovery and dampening prospects for metals demand. Despite expectations of a surplus in the zinc market for 2024, with output growth outpacing demand, the metal found some support from hopes for a fuller economic recovery in China. The International Lead and Zinc Study Group (ILZSG) reported that the global zinc market shifted from a deficit of 62,000 metric tons in September to a deficit of 52,500 metric tons in October. For the first 10 months of 2023, the ILZSG data showed a surplus of 295,000 tons compared to a deficit of 33,000 tons in the same period of 2022. Technically, the zinc market is under long liquidation, marked by a drop in open interest by -1.82% to settle at 2478. Prices are finding support at 222.1, and a breach below may lead to a test of 221.1 levels. On the upside, resistance is likely at 224.1, with a move above potentially pushing prices to test 225.1.

Trading Ideas:

* Zinc trading range for the day is 221.1-225.1.

* Zinc steadied as investors weigh industrial outlook after US data

* Zinc inventories in Shanghai Futures Exchange warehouses rose 15.2% from last Friday

* Zinc market is projected to have a surplus in 2024, with output growth outpacing demand.

Aluminium

Aluminium prices faced a decline of -0.74%, settling at 201.6, reflecting concerns about China's economic conditions. China's central bank is expected to increase liquidity and reduce a key interest rate as part of efforts to stabilize the economy facing deflationary pressures. Despite a slight uptick in exports, weak domestic activity remains a challenge for a quick turnaround. In the aluminium market, the premium for shipments to Japanese buyers in January to March was set at $90 per metric ton, down 7% from the previous quarter. This decline is attributed to sluggish demand, with the figure marking the lowest since the first quarter of 2023 and falling below initial offers from global producers. Japan, as Asia's largest aluminium importer, plays a significant role in setting benchmarks for the region. Aluminium stocks at major Japanese ports were at 330,000 tons in November, exceeding the healthy range of 250,000-300,000 tons. This surplus occurred despite a 27% year-on-year drop in Japan's import of primary aluminium ingots over the period from January to November. Technically, the aluminium market is under fresh selling pressure, evidenced by a gain in open interest by 0.09% to settle at 4255. Prices are currently finding support at 200.7, and a breach below could lead to a test of 199.9 levels. On the upside, resistance is likely at 202.8, with a move above potentially pushing prices to test 204.1.

Trading Ideas:

* Aluminium trading range for the day is 199.9-204.1.

* Aluminium dropped as China's economy is shaky with deflationary pressures and weak domestic activity.

* China’s Factory-gate prices continue to decline, indicating deflationary pressures and dimming prospects for demand.

* Consumer and producer deflation in China prompts expectations of more stimulus measures.

Cotton

Cotton prices, represented as Cottoncandy, experienced a marginal decline of -0.04%, settling at 55,600. The Cotton Association of India (CAI) estimates domestic consumption for the 2023-24 season to remain flat at 311 lakh bales. The pressing estimates for the same period are maintained at 294.10 lakh bales. CAI's observations are based on inputs from members and trade sources, and they have retained the total cotton supply till the end of the 2023-24 season at 345 lakh bales. Brazil's cotton production reached a historic high in the 2022-23 season, leading to an increase in global supply. However, sluggish demand, influenced by unfavorable economic conditions, resulted in bloated inventories and reduced cotton prices worldwide. Brazilian cotton shipments in November increased by 12% compared to October 2023 but decreased by 5.5% compared to November 2022. Global cotton lint production is expected to grow 3.25% YoY to 25.4 million metric tons in the 2023-2024 season, while consumption is forecasted to marginally decline to 23.4 million metric tons. In the U.S., the cotton balance sheet for the 2023/24 season shows slightly lower consumption but higher production and ending stocks. Ending stocks are projected at 3.2 million bales, representing 22.5% of use. In the Rajkot spot market, prices concluded at 26,389.55 Rupees, indicating a minor drop of -0.07%. From a technical standpoint, the market is under fresh selling pressure, with a 2.46% increase in open interest to 208. Cottoncandy finds support at 55,480, and a breach below could lead to a test of 55,360 levels. On the upside, resistance is likely at 55,740, with a move above potentially pushing prices to test 55,880.

Trading Ideas:

* Cottoncandy trading range for the day is 55360-55880.

* Cotton settled flat as consumption in India for the 2023-24 season is estimated to remain flat at 311 lakh bales.

* The total cotton supply in India until the end of the 2023-24 season is estimated to be 345 lakh bales.

* Global cotton production is projected to exceed consumption for the second consecutive year.

* In Rajkot, a major spot market, the price ended at 26389.55 Rupees dropped by -0.07 percent.

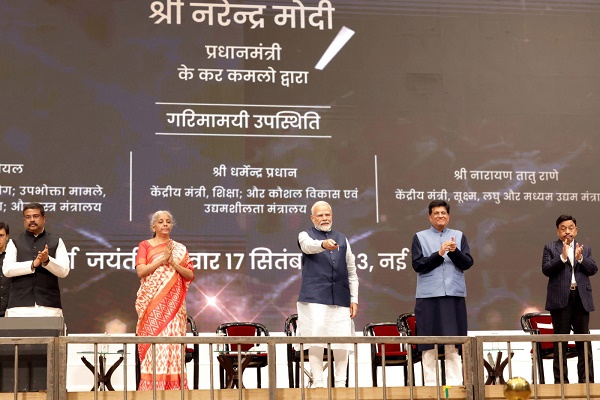

Turmeric

Turmeric prices witnessed a decline of -0.9%, settling at 12,938, influenced by slower buying activities ahead of the anticipated release of stocks in anticipation of the commencement of new crops in January 2024. The market also experienced pressure due to favorable weather conditions improving crop conditions. However, the downside is expected to be limited as potential yield losses caused by unfavorable weather conditions and improved export opportunities offer support. The Turmeric Board in Telangana, initiated by Prime Minister Modi, has raised concerns among farmers in Maharashtra regarding the headquarters' location. Despite expectations of a decline in turmeric seeding by 20–25%, especially in regions like Maharashtra, Tamil Nadu, Andhra Pradesh, and Telangana, the demand for turmeric has increased, leading to a 25% rise in exports. Turmeric exports during Apr-Oct 2023 registered a modest increase of 2.63% at 102,162.94 tonnes compared to 99,585.88 tonnes during the same period in 2022. In October 2023, turmeric exports amounted to 10,137.78 tonnes, showing an 11.58% gain compared to September 2023. However, there was a 9.30% decline in exports compared to October 2022. In the major spot market of Nizamabad, prices concluded at 12,887.6 Rupees, representing a marginal drop of -0.25%. From a technical perspective, the market is under fresh selling pressure, with a 1.22% increase in open interest to 12,060. Turmeric finds support at 12,696, and a breach below could lead to a test of 12,454 levels. On the upside, resistance is likely at 13,134, with a move above potentially pushing prices to test 13,330.

Trading Ideas:

* Turmeric trading range for the day is 12454-13330.

* Turmeric dropped as buying activities has been slower.

* Pressure also seen amid improved crop condition due to favorable weather condition.

* However, downside seen limited due to the potential for yield losses caused by the crop's unfavourable weather.

* In Nizamabad, a major spot market, the price ended at 12887.6 Rupees dropped by -0.25 percent.

Jeera

Jeera prices recorded a notable decline of -1.13%, settling at 26,205, primarily influenced by the anticipation of higher production in key cultivating regions such as Gujarat and Rajasthan. The market faces downward pressure due to aggressive sowing activities for Jeera in Gujarat, coupled with sluggish export demand, which is expected to keep prices under pressure in the near term. Sowing for Jeera in Gujarat has witnessed a substantial increase of nearly 102%, reaching 544,099 hectares compared to 268,775 hectares in the same period in 2022. In Rajasthan, there has been a 13% rise in cumin cultivation, with Jeera sown in 6.32 lakh hectares. The favorable weather conditions during sowing have contributed to the robust growth in cultivation. However, the surge in production comes at a time when global demand for Indian Jeera has slumped, as buyers prefer alternative origins like Syria and Turkey due to comparatively higher prices in India. In October 2023, Jeera exports dropped by 13.39% to 6,228.01 tonnes compared to September 2023 and by 46.77% compared to October 2022. In the Unjha spot market, prices concluded at 30,858.15 Rupees, representing a decrease of -0.35%. From a technical standpoint, the market is characterized by fresh selling, with a 0.16% increase in open interest to 1,839. Jeera finds support at 25,920, and a breach below could lead to a test of 25,630 levels. On the upside, resistance is likely at 26,480, with a move above potentially pushing prices to test 26,750.

Trading Ideas:

* Jeera trading range for the day is 25630-26750.

* Jeera gains on short covering after prices dropped due to higher production prospects

* In Gujarat, Cumin sowing witnessed very strong growth by nearly 103% with 530,030.00 hectares against sown area of 2022

* Stockists are showing interest in buying on recent downfall in prices triggering short covering.

* In Unjha, a major spot market, the price ended at 30858.15 Rupees dropped by -0.35 percent.