Trade Deficit : Gold leads import surge; US export hit mitigated for now by Emkay Global Financial Services

Gold leads import surge; US export hit mitigated for now

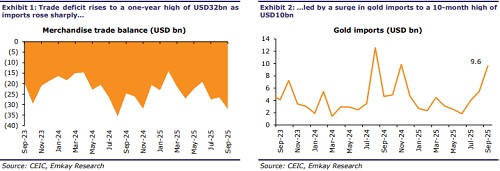

Merchandise trade deficit rose to a one-year high of USD32.1bn in Sep (Aug: USD26.5bn), primarily due to a surge in gold imports to USD10bn. Surprisingly, exports improved sequentially (3% MoM) despite a ~20% fall in US exports, as healthy export growth to EU, Middle East, and Asia mitigated the impact. Notably, tariff-hit sectors are also yet to see an adverse impact. Services surplus stayed stable at USD15.6bn, though that for Aug was revised down heavily, with services exports now showing negative growth. US export frontloading has helped keep the core exports trend healthy for 1HFY26, although this will now weaken as the 50% tariff hit continues. We maintain FY26E CAD/GDP at 1.2%, with negative (-6%) goods exports growth, led by the US. Net services export growth is also likely to slow down due to global uncertainty.

Gold import surge drives higher deficit, while exports rise despite US tariffs

Merchandise trade deficit rose to a one-year high of USD32.1bn (vs USD26.5bn in Aug), mainly due to a sharp rise in imports (USD68.5bn; 11% MoM, 17% YoY). Surprisingly, exports also increased (USD36.4bn; 4% MoM, 7% YoY) despite the 50% US tariff hit being felt over the full month. The higher imports were driven by gold imports rising to a 10-month high of USD9.8bn (77% MoM, 107% YoY), ahead of the festive season, with gold prices rising ~10%. Oil imports also increased, to USD14bn (6% MoM), while oil exports rose 11% MoM to USD5bn. For 1HFY26, total exports are at USD220bn with 3% growth, while imports have risen 5% to USD375bn despite both gold (USD27bn, -9% YoY) and oil (USD92bn, -1% YoY) being lower. As a result, the goods trade deficit for 1HFY26 stands at USD155bn (vs USD145bn last year).

Core deficit rises, though export growth trends have been better than imports

Core (non-oil, non-gold) deficit also rose, to USD16.3bn, with core exports (USD28.6bn, 1% MoM) rising less than core imports (USD44.9bn, 5% MoM). 1HFY26 has seen core exports at USD175bn (6% YoY), while core imports are at USD257bn (8% YoY). However, recent growth trends for core exports have been better than those for core imports, reflecting frontloaded US exports in 1HFY26. Among major export categories, Electronics (42% YoY for 1HFY26) have been the best performer, followed by Drugs and Pharma (6% YoY), Engineering Goods (5% YoY), and Organic and Inorganic Chemicals (3% YoY). Notably, tariff-affected sectors (Textiles, Gems and Jewelry) are yet to see any impact.

US exports drop sharply; mitigated by the EU, Middle East, Asia

Notably, exports to the US fell 20% MoM to USD5.5bn and are down ~32% from the pre50% tariff July-level of USD8bn. However, frontloading of exports has meant that exports to the US were still ~13% higher for 1HFY26 (USD46bn vs USD40bn). While detailed data is awaited, initial estimates suggest that exporters were able to divert goods to Europe, the Middle East, and Asia, to mitigate US tariffs. With India searching for avenues to mitigate US tariffs, sharp jumps in exports to non-key markets (Hong Kong, Bangladesh, etc) may indicate some transshipment, although a trend is yet to emerge.

Services surplus stays steady, though export growth is starting to falter

Services surplus stayed steady at USD15.5bn in September, from the heavily downwardrevised USD15.6bn in August (USD16.6bn earlier). Provisional services surplus for 1HFY26 is USD95bn, up 13%; however, gross services exports (USD193bn) have grown only 6%. For September, exports (USD31bn) declined 1% MoM, while imports (USD15bn) fell 2% MoM. Services exports, especially software services, are facing headwinds in FY26 from tariff-led global uncertainty, and growth is now starting to materially slow down.

FY26E CAD/GDP maintained at 1.2%

We maintain FY26E CAD/GDP at 1.2%, with negative merchandise export growth (-6%), especially US exports (-15%), even with non-oil import growth likely to slow down with sluggish domestic demand. Our estimates suggest that ~60% of Indian exports to US facing 50% tariffs will see a ~33% drop in FY26E, while the remaining (tariff-free) categories could still see healthy growth. The goods trade deficit/GDP is likely to rise to 7.6% of GDP (FY25: 7.3%), with Electronics exports being resilient. Net services exports are also likely to see slower growth, especially IT Services, due to global uncertainty and a potential US growth slowdown.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354