BoJ Delivers 25 Bps Rate Hike, On Expected Lines by Ankita Pathak, Ionic Wealth

In a widely anticipated move, Bank of Japan (BoJ) unanimously voted for 25 bps policy rate hike to 0.75%, highest level in the last 30 years. Inflation in Japan continues to be above BoJ’s target of 2.0% for a prolonged period, while growth shows signs of some weakness. This trade-off between containing inflation and avoiding undue pressure on growth has kept the pace of rate normalization deliberately gradual.

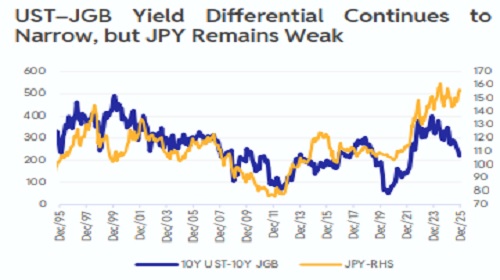

The yield differential between UST and JGB continue to narrow as both the central banks are currently on opposite sides on the monetary policy. Although this has not benefitted JPY amid slower pace of rate hikes by the BoJ.

Scope for further hikes

BoJ intends to hike rates further if growth and inflation evolve in line with its expectations. Growth is expected to be stable at around 0.7% in FY26, same as FY25, while inflation is expected to moderate to 1.8% in FY26 from 2.7% in FY25. Neutral rate for Japan remains uncertain, sitting on a wider range (1%-2.5%). The Central Bank aims to be data dependent and see at how the economy and prices react to each change in rates.

Market Reaction- Nikkei up, JPY weakened and 10Y JGB edged higher

The rate hike decision supported the Japan equity market, with Nikkei index rising ~1.4% from previous close, while JPY lost some strength and depreciated by 0.18%. 10Y JGB edged higher to 2.0%, highest since 2006.

Ionic Wealth View

Even after hiking rates by 50 bps in this calendar year, the real interest rate in Japan remains extremely negative ~ at 2.2%, thereby underscoring BoJ’s intent to also support growth while attempting to curb inflation. We believe fears of complete, sudden unwinding of carry trade are rather overblown. A) BOJ has long exited the ZIRP (zero interest rate policy) regime so the trade has been less attractive B) The rate gap between Japan and other major economies is expected to narrow, reducing the structural appeal of funding in yen against USD or EUR assets c) investors now use a broader mix of funding currencies and instruments (e.g., dollar funding via repo, euro funding, derivatives) so the yen is no longer uniquely central to global carry structure and D) Yen is now more subject to policy movements vs the last decade. While some effects are rather possible, the quantum of yen carry trade is already lower than the past decades. We believe, the pace of rate hikes to remain well calibrated, as growth concerns linger

Above views are of the author and not of the website kindly read disclaimer