This fund has grown your money 6.87x in the past 20 years by Kotak ELSS Tax Saver Fund

Kotak ELSS Tax Saver Fund completes 20 years this month with a remarkable milestone - its assets under management (AUM) have crossed Rs 6,449 crore mark. The fund has grown investors' money by 6.87x in the past 20 years, the fund’s performance signifies the Kotak Mutual Fund’s motto of growing investors’ wealth through mutual fund investments.

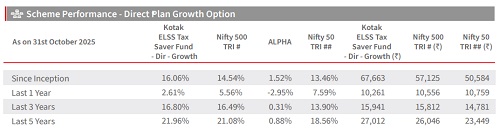

The inception of Kotak ELSS Tax Saver Fund dates back to 23rd November 2005. Rs 10,000 lumpsum investment in the fund during the time of inception would have turned to Rs 68,753 with a compounded average growth rate (CAGR) by over 16.13%. The fund has beaten benchmark NIFTY 500 TRI returns of 14.58%.

Understanding the return for a SIP investor, a Rs 10,000/month SIP (since inception) would have turned an investment of Rs 24 lakhs into Rs 1.13 crore a CAGR of 13.71%. The fund is managed by Harsha Upadhyaya for Kotak Mahindra Asset Management (India). The scheme demonstrates strong risk-adjusted performance across market phases.

Fund predominately invests in equities, providing the potential for capital appreciation along with the benefit of tax savings for investors. The scheme will endeavour to generate return by investing in equity and equity linked instruments across the market capitalisations. Fund follows a bottom up stock selection with a top down thematic overlay which helps identify stock opportunities.

Key metrics underline the fund’s performance strength:

* Portfolio turnover ratio is 19.49%

* Sharpe Ratio at 0.75%

* Lastly, the standard deviation of 12.65%

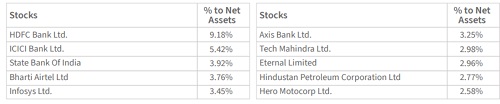

Currently, the investment focus is on businesses that have reasonable visibility on earnings going forward. The top overweight sectors are – Chemicals and Construction. The key underweight sectors in the portfolio are – Metals and Consumer Durables. Large/Mid/Small cap exposures in the portfolio are at 69:20:9 respectively.

Above views are of the author and not of the website kindly read disclaimer

.jpg)