The Nifty index failed to sustain near the psychological 25000 mark, succumbing to unwinding pressure below this crucial hurdle - Tradebulls Securities Pvt Ltd

Nifty

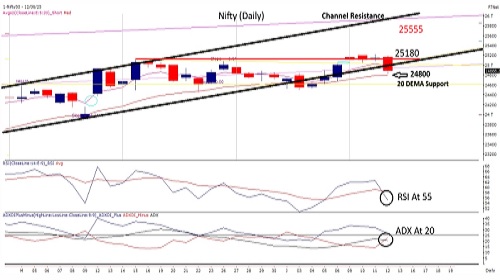

The Nifty index failed to sustain near the psychological 25000 mark, succumbing to unwinding pressure below this crucial hurdle. The appearance of consecutive narrow-range candlesticks signaled weakening momentum, highlighting the need for a strong follow-through close above 25180 to reaffirm bullish strength. Despite the recent dip, technical indicators remain supportive. The daily RSI holds above the 50 mark, while ADX is rebounding near the 20 zone — both suggesting latent strength. Immediate support is now seen around 24760, a confluence zone comprising the 20-day EMA and 5-week EMA. However, the index has slipped below the lower band of its rising channel. A swift rebound and close above 25040 is necessary to negate this breakdown. Failure to do so would confirm a structural breach. On the weekly chart, a bullish ‘Rising Three’ candlestick formation continues to support the ongoing uptrend — unless invalidated by a weekly close below the pattern’s support. Options data indicates firm resistance levels at 25000, followed by 25200 while support levels are placed at 24800, with a stronger base at 24500. Key tactical levels to monitor for the day would be a sustained closing breach below 24800 on weekly scale may trigger caution and invite profit booking. Only a sustained reversal above 25040 can justify holding existing long positions for a potential trend continuation and breakout expectations above 25180.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838