The JPY continued its drop against the dollar, setting its sights on the 157 handle as traders focused on the yield differential - Axis Securities Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

USD/INR

Market Commentary:

* The Dollar index dropped, driven by softer US 10-year bond yields ahead of inflation data due tomorrow. USD/INR continued its upward drift to end the session above 83.50, a drop that was in-line with the Asia dollar gauge that fell for the fourth session in five.

* On the daily chart, the pair continues to trade above the short term (5/13/21) EMAs. Resistance lies near 83.70 followed by 83.90, while supports lie between 83.10 – 83.30.

* Daily stochastics are currently bullish but are nearing overbought at the 90 territory. No notable strikes are due to expire on the day.

* Bloomberg’s FX forecast model suggests there is a 9.0% probability that the pair will touch 83.67 while there is a 12.1% chance that it will hit 83.40

EUR/INR

Market Commentary:

* The softness in the dollar index supported the common currency, which briefly rose above 1.08. That supported the INR cross too, as it continues to trade above the key short-term EMAs.

* The pair is expected to find support in the 89.80/90 area, while near-term resistance can be seen within the 90.20/40 zone.

* Notable strikes set to expire today for EUR/USD lie at 1.0760 and 1.0780.

* The MA-based Z-score is near overbought, while the daily stochastics oscillator has turned bearish.

* Bloomberg’s FX forecast model suggests there is a 10.2% chance that the pair will touch 90.58 today while there is a 9.8% probability that it will reach 89.56.

GBP/INR

Market Commentary:

* The pair’s three-day rise saw it move toward 1.2600 as the dollar traded soft. The INR cross was well supported by both the pound and the USD/INR rising, although it did face some rejection around 104.70.

* Technically, the 104.40 - 104.50 area - the short term EMAs are clustering here - is expected to serve as support, beyond which 104.00 is a possibility. Immediate resistance lies near 104.80 – 105.00.

* Notable strikes set to expire today lie at 1.2465, 1.2500, 1.2525, 1.2600.

* The stochastics oscillator currently remains in a bearish regime.

* Bloomberg’s FX forecast model suggests there is a 10.6% probability that the pair will touch 105.15, while there is a 9.6% probability that it will hit 104.14.

JPY/INR

Market Commentary:

* The JPY continued its drop against the dollar, setting its sights on the 157 handle as traders focused on the yield differential. The INR cross ended the day with a doji candlestick, representing indecision.

* Immediate support for the pair lies around 0.5300 followed by 0.5330. The 21-day moving average lies around 0.5400 and is expected to act as a near-term hurdle.

* Notable strikes set to expire today are at 155.08, 155.50, 156.00, 156.35.

* The MA-based z-score has reversed after turning overbought while the stochastic oscillator remains bearish.

* Bloomberg’s FX forecast model suggests there is a 10% probability that the pair will hit 0.5397 or 0.5323.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Top News

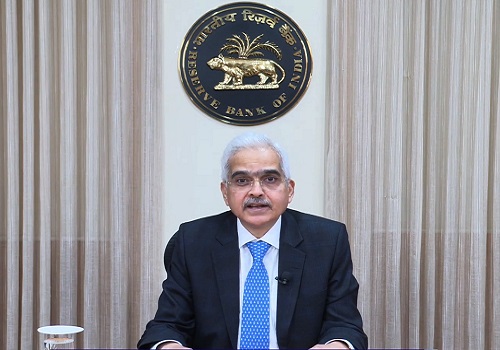

RBI supports fintech sector, but customer interest is of prime importance:Governor Shaktikan...

Tag News

Buy USDINR Dec @ 85.1 SL 85 TGT 85.2-85.3. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">