The Indian rupee is expected to start the week on a muted note with the stable Asian currencies - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Market Roundup

The Indian rupee is expected to start the week on a muted note with the stable Asian currencies. The calmness over the weekend and recovery in the risk assets pushed the haven dollar lower while equities in Asian trading higher. US equity futures are slightly higher in early Monday business, with investors relieved there was nothing too concerning from the Middle East over the weekend.

The forward markets suggest the spot USDINR opening around 83.45 from Friday’s close of 83.47. Technically, the bias remains bullish as long as the pair holds 83.20. In the near term, it has resistance at 83.70 and support at 83.20. On Monday, the dollar was down while the yield on 10-year US Treasury yields advanced as haven demand let up slightly.

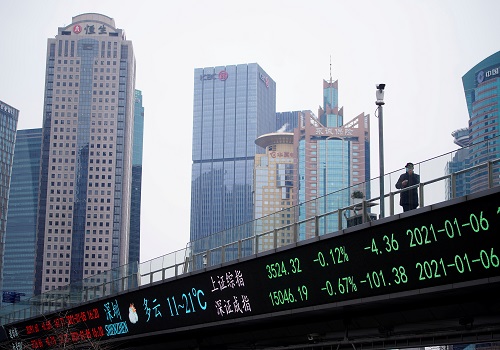

Another hold on loan prime rates by Chinese commercial lenders tracks the People’s Bank of China’s decision last week to keep its one-year rate steady. Increasing downward pressure on the yuan limits China’s room to ease monetary policy in the near term.

European Central Bank President Christine Lagarde highlighted both up and downside risks to inflation as she reiterated her institution’s stance on a potential reduction of interest rates. The European Central Bank has a clear case to lower interest rates twice. Still, Governing Council member Pierre Wunsch said that what happens after that is difficult to predict because of uncertainty over domestic inflation pressures.

Bank of England policymaker Catherine Mann said the fragmenting global economy will leave countries more exposed to inflation shocks in future, posing a test for central banks. Bank of England Deputy Governor Dave Ramsden signalled he is less concerned about UK inflation than in previous months, a sign he may be willing to support interest rate cuts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">