The Indian rupee is expected to open flat after Tuesday`s muted trading session - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Market Roundup

It’s pretty light on the economic front on Wednesday. The Indian rupee is expected to open flat after Tuesday’s muted trading session. The weakness in domestic equities following foreign fund selling and the stronger greenback could weigh on the local rupee in the near term.

On Tuesday, spot USDINR gained 2 paise to 83.515, gained for the third day in a row. Technical set-up remains constructive for the bulls amid higher dollar demand. However, the central bank’s intervention. The pair has support at 83.30 and resistance at 83.60 with a positive bias.

Forex:

Asian currencies were mostly weaker against the dollar. The dollar index strength rose the most in a week as Treasury yields pared losses amid a rebound in WTI oil prices and after comments by Federal Reserve Bank of Minneapolis President Neel Kashkari.

Federal Reserve Bank of Minneapolis President Neel Kashkari says recent inflation data raise questions about whether monetary policy is restrictive enough to return price growth down to the central bank’s 2% target.

European Central Bank Governing Council member Joachim Nagel said forces including geopolitics and decarbonization could keep consumer-price growth elevated in the years ahead.

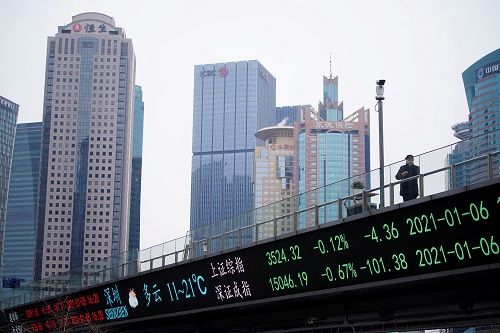

Equities:

Stocks in Asia slid following a sluggish US session, with investors seeking firm evidence of an earnings recovery before taking this month’s rally further. the S&P 500 failed to crack a psychological resistance level at around 5200 while the Dow is officially on its longest winning streak since December 2022. Contracts for US stocks were little changed in Asia trading after the S&P 500 eked out a fourth session of advance.

Commodities:

Oil was little changed as traders tracked tensions in the Middle East and a mildly bearish US stockpiles report. The U.S. Energy Information Administration said Tuesday that it expects the OPEC and allies to maintain at least some of their production cuts beyond the second quarter.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Tag News

Daily Commodity Market Outlook 23.12.2024 by Mr. Anuj Gupta, HDFC Securities

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">